US Gasoline Inventories Pressured Gasoline and Crude Oil Futures

The EIA reported that US gasoline inventories rose by 22,000 barrels or 0.1% to 231.1 MMbbls (million barrels) on August 4–11, 2017.

Aug. 17 2017, Published 10:00 a.m. ET

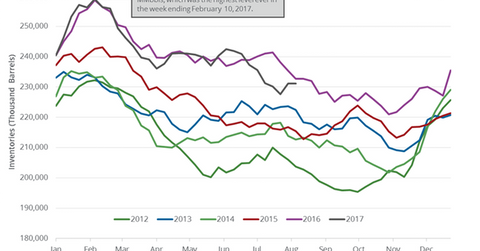

US gasoline inventories

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on August 16, 2017. It reported that US gasoline inventories rose by 22,000 barrels or 0.1% to 231.1 MMbbls (million barrels) on August 4–11, 2017. Inventories rose for the second straight week. US gasoline inventories fell by 1.5 MMbbls or 0.7% YoY (year-over-year).

According to a market survey, US gasoline inventories would have fallen by 1.1 MMbbls on August 4–11, 2017. US gasoline futures fell on August 16, 2017, due to the unexpected rise in gasoline inventories. It also pressured US crude oil (UCO) (XLE) (XOP) futures on the same day. US gasoline futures fell 1% to $1.56 per gallon on August 16, 2017.

Lower gasoline prices have a negative impact on refiners’ earnings like Western Refining (WNR) and Marathon Petroleum (MPC). Lower crude oil prices have a negative impact on oil producers’ earnings like ConocoPhillips (COP), Stone Energy (SGY), and Denbury Resources (DNR).

US gasoline production, imports, and demand

The EIA estimates that US gasoline production fell by 253,000 bpd (barrels per day) or 2.5% to 10.05 MMbpd (million barrels per day) on August 4–11, 2017. Production fell by 232,000 bpd or 2.3% from the same period in 2016.

US gasoline imports fell by 441,000 bpd or 40% to 667,000 bpd on August 4–11, 2017. Imports rose by 57,000 bpd or 9.3% from the same period in 2016.

US gasoline demand fell by 275,000 bpd or 2.8% to 9.5 MMbpd on August 4–11, 2017. Demand fell by 240,000 bpd or 2.4% from the same period in 2016. US gasoline demand hit 9.8 MMbpd for the week ending July 28, 2017—the highest level ever.