US Crude Oil Inventories Fall in Line with Market Expectations

A Reuters survey estimated that US crude oil inventories would fall 3.5 MMbbls between August 11, 2017, and August 18, 2017.

Aug. 24 2017, Published 12:56 p.m. ET

EIA’s crude oil inventories

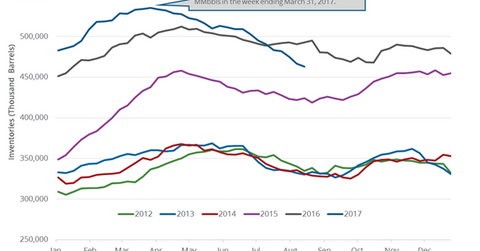

On August 23, 2017, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report. It reported that US crude oil inventories fell by 3.3 MMbbls (million barrels) to 463.1 MMbbls between August 11, 2017, and August 18, 2017. Inventories fell 0.7% week-over-week and 29.7 MMbbls or 6% year-over-year. US crude oil inventories are at the lowest level since January 22, 2016.

A Reuters survey estimated that US crude oil inventories would fall 3.5 MMbbls between August 11, 2017, and August 18, 2017. US crude oil (RYE) (VDE) prices rose on August 23, 2017, due to the fall in inventories.

Higher crude oil (ERY) (ERX) prices have a positive impact on energy producers. The returns of the top energy companies by volume (or shares traded) as of August 23, 2017, are as follows:

Why US crude oil inventories fell last week

US refinery crude oil demand fell by 104,000 bpd (barrels per day), or 0.6%, to 17,461,000 bpd between August 11, 2017, and August 18, 2017. Refinery demand rose 782,000 bpd, or 4.6%, in the same period in 2016. Refinery demand hit 17,574,000 bpd for the week ending August 4, 2017, the highest level since 1982.

US crude oil imports rose by 664,000 bpd or 8% to 8,790,000 bpd between August 11, 2017, and August 18, 2017. Imports rose 148,000 bpd, or 1.7%, during the same period in 2016.

A rise in US crude oil imports and production led to the fall in US crude oil inventories between August 11, 2017, and August 18, 2017. The possible rise in US crude oil exports might have also contributed to the fall in US crude oil inventories. A fall in US refinery demand could have limited the fall in US crude oil inventories between August 11, 2017, and August 18, 2017.

Impact of US crude oil inventories

US crude oil inventories are below the five-year average. Inventories have fallen almost 14% from the peak. An expectation of a fall in US crude oil inventories could benefit crude oil (DWT) (UWT) prices in the coming weeks.

In the next part, we’ll look at why US crude oil production is bearish for crude oil prices.