Crude Oil: Price Forecasts and Hedge Funds’ Position

Hedge funds increased their net long positions in US crude oil futures and options by 43,861 contracts or 18.4% to 282,362 contracts on July 25–August 1.

Nov. 20 2020, Updated 4:21 p.m. ET

Hedge funds

On August 4, 2017, the U.S. Commodity Futures Trading Commission released its weekly “Commitments of Traders” report. It reported that hedge funds increased their net long positions in US crude oil futures and options by 43,861 contracts or 18.4% to 282,362 contracts on July 25–August 1, 2017.

Hedge funds’ net long positions rose by 195,545 contracts or 225% from the same period in 2016. Hedge funds’ net long positions on US crude oil rose for the fifth straight week. It suggests that hedge funds are turning bullish on crude oil (IXC) (IYE) (FXN).

Higher crude oil (FENY) (USL) prices have a positive impact on oil producers like Continental Resources (CLR), ConocoPhillips (COP), PDC Energy (PDCE), and Sanchez Energy (SN).

Crude oil price forecasts

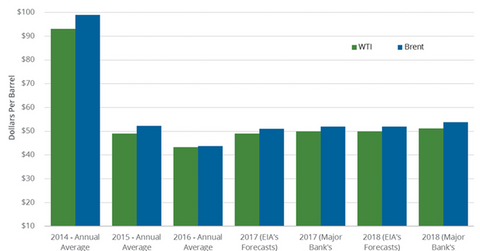

The EIA released its Short-Term Energy Outlook report on August 8, 2017. It estimates that WTI crude oil prices will average $48.8 per barrel in 2017—0.1% lower than the previous estimates.

The EIA also estimates that Brent crude oil prices will average $50.71 per barrel in 2017—0.1% lower than the previous estimates.

WTI and Brent crude oil prices averaged $43.3 per barrel and $43.7 per barrel, respectively, in 2016.

Credit Suisse expects that the crude oil market won’t rebalance until 3Q18. It also expects that global crude oil inventories will be 120 MMbbls (million barrels) above their five-year average when the production cut deal expires in March 2018.

Read Decoding Global Crude Oil Demand and Supply Drivers and Will the OPEC and Non-OPEC Meeting Drive Crude Oil Futures? for more information.

For more on natural gas, read Supply and Demand Could Drive Natural Gas Prices Higher.