US Distillate Inventories Fell for the Second Straight Week

The EIA reported that US distillate inventories fell by 1.8 MMbbls (million barrels) or 1.2% to 150.4 MMbbls on June 23–30, 2017.

July 7 2017, Updated 12:36 p.m. ET

US distillate inventories

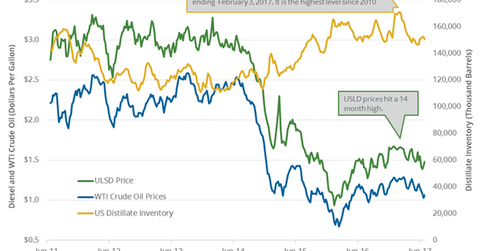

The EIA (U.S. Energy Information Administration) released its weekly crude oil and gasoline inventory report on July 6, 2017. It reported that US distillate inventories fell by 1.8 MMbbls (million barrels) or 1.2% to 150.4 MMbbls on June 23–30, 2017. Inventories fell for the second straight week. However, distillate inventories rose 1% from the same period in 2016.

Diesel futures fell despite the surprise fall in US distillate inventories. US diesel futures fell 0.7% to $1.48 per gallon on July 6, 2017. Crude oil (ERY) (ERX) (IXC) futures rose on July 6, 2017. US crude oil and diesel futures usually move together, as you can see in the following chart.

Moves in crude oil prices impact US crude oil producers’ earnings like Comstock Resources (CRK), Western Refining (WNR), Marathon Petroleum (MPC), and Northern Oil & Gas (NOG).

API’s distillate inventories

On July 5, 2017, the API (American Petroleum Institute) released its weekly crude oil inventory report. It estimated that distillate inventories rose by 0.37 MMbbls on June 23–30, 2017.

US distillate production and demand

The EIA estimates that US distillate production fell by 144,000 bpd (barrels per day) or 2.7% to 5,100,000 bpd on June 23–30, 2017. Distillate demand rose by 293,000 bpd or 7.2% to 4,322,000 bpd during the same period.

Impact

US distillates inventories are above the five-year range. High distillate inventories would pressure diesel prices, which in turn weighs on crude oil prices.

For more on the crude oil’s price forecast, read Hedge Funds’ Net Bullish Positions on US Crude Oil.

Read Will OPEC and Russia Pressure US and Brent Crude Oil Futures? and Why Brent and US Crude Oil Futures Could Make a U-Turn to learn about crude oil.