Hedge Funds’ Net Long Positions in US Crude Oil Rose Again

Hedge funds increased their net bullish positions in US crude oil futures and options rose by 36,834 contracts to 215,488 contracts on July 11–18, 2017.

Nov. 20 2020, Updated 3:17 p.m. ET

Hedge funds

The U.S. Commodity Futures Trading Commission released its weekly “Commitments of Traders” report on July 21, 2017. The report showed that hedge funds increased their net bullish positions in US crude oil futures and options rose by 36,834 contracts to 215,488 contracts on July 11–18, 2017. Hedge funds’ net bullish positions rose 21% week-over-week and 37.4% year-over-year. Hedge funds’ net bullish positions on US crude oil rose for three consecutive weeks. It suggests that hedge funds are turning bullish on crude oil (FXN) (FENY) (ERY).

Changes in crude oil prices impact oil and gas producers’ earnings like Continental Resources (CLR), QEP Resources (QEP), and Comstock Resources (CRK).

Crude oil price forecasts

Commodity trading company CHS Hedging expects that US crude oil prices could trade between $40 and $45 per barrel in 2017. CHS Hedging expects that if US crude oil prices test $50 per barrel, it would lead to a rise in US crude oil production and prices could fall.

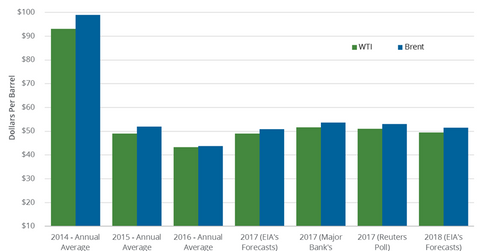

The EIA (U.S. Energy Information Administration) estimates that US crude oil prices will average $48.9 per barrel in 2017 and $49.5 per barrel in 2018.

The EIA also estimates that Brent crude oil prices will average $50.79 per barrel in 2017 and $51.6 per barrel in 2018. US and Brent crude oil prices averaged $43.3 per barrel and $43.7 per barrel, respectively, in 2016.

OPEC’s output cut deal, the fall in exports from Saudi Arabia, and improving global oil demand could support crude oil prices. However, a rise in production from the US, Nigeria, Libya, and Canada could pressure oil (FXN) (FENY) (ERY) prices.

Read Crude Oil Market: Is OPEC Its Own Worst Enemy? to learn more about crude oil.

Read US Natural Gas Market: Exploring Investing Opportunities for more on natural gas.