Near Record US Gasoline Demand: Are the Bulls Taking Control?

The EIA estimates that the four-week average for US gasoline demand rose 129,000 bpd (barrels per day) to 9.7 MMbpd (million barrels per day) from July 7 to 14, 2017.

July 19 2017, Published 9:26 a.m. ET

US gasoline demand

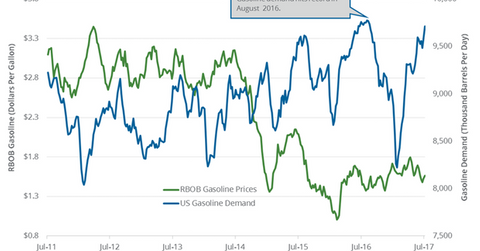

The EIA (U.S. Energy Information Administration) estimates that the four-week average for US gasoline demand rose 129,000 bpd (barrels per day) to 9.7 MMbpd (million barrels per day) from July 7 to 14, 2017. The four-week average for gasoline demand rose 1.3% week-over-week, but it fell 0.3% year-over-year (or YoY).

Weekly US gasoline demand rose 81,000 bpd to 9.8 MMbpd from July 7 to 14. Demand rose 0.8% week-over-week and 1.2% YoY.

Any rise in gasoline demand is bullish for gasoline and crude oil (ERY) (FXN) (FENY) prices. Higher gasoline and crude oil prices positively affect refiners and oil producers such as Denbury Resources (DNR), Bill Barrett Corporation (BBG), Phillips 66 (PSX), Tesoro (TSO), and Western Refining (WNR).

Gasoline demand drivers

The improving labor market and consumer confidence could cause Americans drive more this summer. US weekly gasoline demand was near a record in the week ended July 14, 2017.

US weekly gasoline demand hit a record in May 2017 at 9.82 MMbpd. The four-week average for gasoline demand hit a record of 9.78 MMbpd in August 2016. The shift toward electric vehicles and an improvement in fuel efficiency could partially limit gasoline and crude oil consumption this summer.

Gasoline production and imports

US gasoline production rose 104,000 bpd to 10.5 MMbpd from July 7 to 14, 2017, 2.4% higher than it was during the same period in 2016. US gasoline imports fell 211,000 bpd to 528,000 bpd from July 7 to 14, 2017, 35.6% lower than it was during the same period in 2016.

US gasoline consumption estimates

The EIA estimates that US gasoline consumption will average 9.34 MMbpd in 2017 and 9.39 MMbpd in 2018. Gasoline consumption averaged 9.33 MMbpd in 2016, and it could hit an all-time high in 2018. It hit a record in 2016.