How Marathon Oil’s Divestiture Affected Its Production Mix

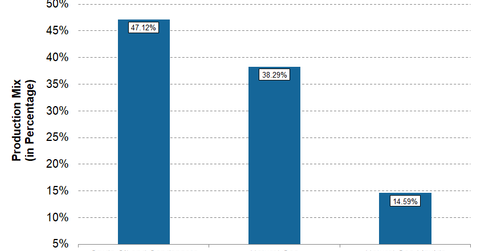

In 2Q17, Marathon Oil’s (MRO) production mix from continuing operations was ~47.0% crude oil and condensate, ~15.0% natural gas liquids, and ~38.0% natural gas.

Sept. 29 2017, Updated 9:12 a.m. ET

Marathon Oil’s production mix

In 2Q17, Marathon Oil’s (MRO) production mix from continuing operations was ~47.0% crude oil and condensate, ~15.0% natural gas liquids, and ~38.0% natural gas. That means that its continuing operations have a total liquids percentage of ~62.0% in the production mix and are tilted toward liquids production. Typically, upstream companies with more crude oil (SCO) and natural gas (UGAZ) liquids production have better operating margins.

Marathon Oil’s production mix trend

In 4Q16, Marathon Oil reported a percentage of ~56.0% for liquids (crude oil, condensate, and synthetic crude oil). However, in 2Q17, MRO closed the sale of its OSM (oil sands mining) business. Its liquids percentage from continuing operations thus came in lower at ~47.0% in 2Q17.

Marathon Oil’s segment-wise production mix

In 2Q17, Marathon Oil’s North American E&P (exploration and production) operations reported a production mix of ~57.0% crude oil (USO) and condensate, ~19.0% of natural gas liquids, and ~24.0% of natural gas (UNG). That means that its 2Q17 production from North American E&P operations contains ~76.0% liquids and is tilted toward liquids production.

Within Marathon Oil’s US resource plays, 2Q17 production from the Bakken Shale reported the highest crude oil and condensate percentage of ~80.0% in its production mix. MRO’s production from the Oklahoma Resource Basin reported the lowest crude oil and condensate percentage of ~29.0% in its production mix.

For 2Q17, Marathon Oil’s International E&P operations reported a production mix of ~27.0% crude oil, ~10.0% natural gas liquids, and ~63.0% natural gas. That means Marathon Oil’s production from International E&P operations is tilted toward natural gas.

Marathon Oil’s OSM operations produced 100% synthetic crude oil in 2Q17.

Peers

Other upstream companies with higher crude oil percentages in their production mixes are Devon Energy (DVN) and Occidental Petroleum (OXY), with ~44.0% and ~73.0%, respectively, of crude oil (USO) in their production mixes. The volatility in oil prices also impacts ETFs and ETNs such as the Vanguard Energy ETF (VDE), the ProShares UltraShort Bloomberg Crude Oil ETF (SCO), and the VelocityShares 3x Long Crude Oil ETN (UWTI).

Next, let’s take a look at Marathon Oil’s oil and gas revenue mix for 2Q17.