VelocityShares 3x Long Crude Oil ETN

Latest VelocityShares 3x Long Crude Oil ETN News and Updates

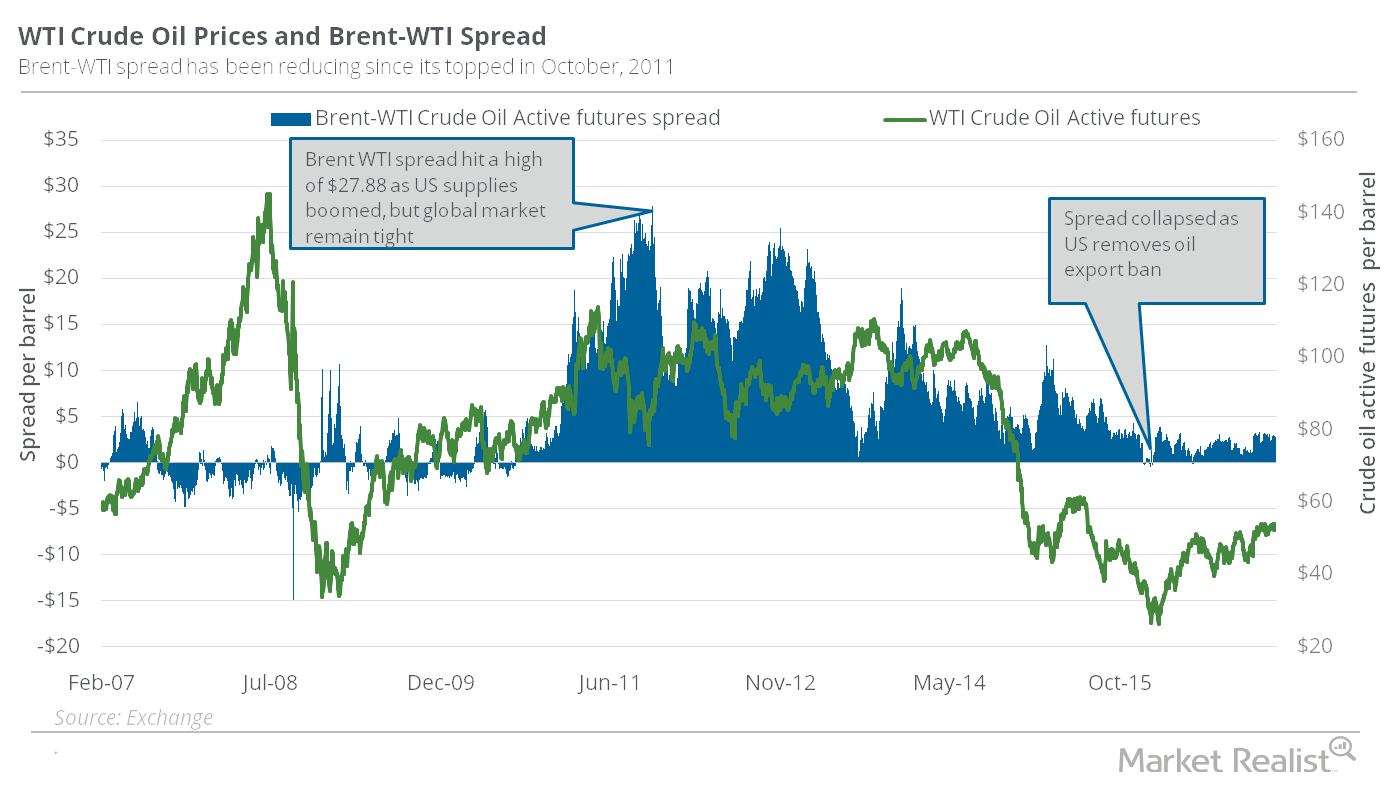

Brent-WTI Spread Impacts Your Oil-Related Investments

On February 14, WTI crude oil (USO) (USL) (OIIL) (SCO) active futures traded at a discount of $2.84 per barrel compared to Brent crude oil active futures.

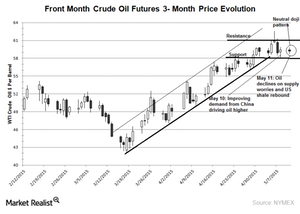

Uncertain Times for the Crude Oil Market: Neutral Doji Pattern

June WTI crude oil futures showed the neutral doji pattern on May 9. Oil prices are swinging due to the frequent change in supply and demand dynamics.

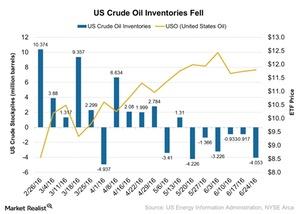

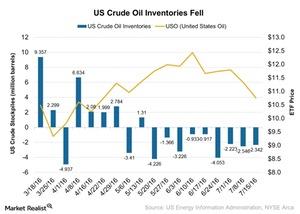

US Crude Oil Inventories Fall Again: How Is Crude Oil Reacting?

According to the U.S. Energy Information Administration’s report on June 29, 2016, US crude oil inventories fell by 4.1 MMbbls in the week ended June 24, 2016.

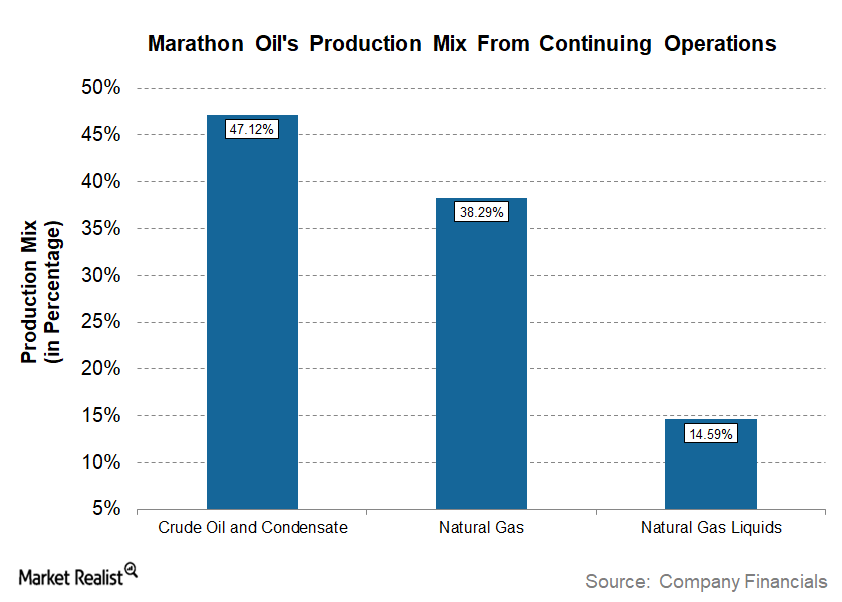

How Marathon Oil’s Divestiture Affected Its Production Mix

In 2Q17, Marathon Oil’s (MRO) production mix from continuing operations was ~47.0% crude oil and condensate, ~15.0% natural gas liquids, and ~38.0% natural gas.

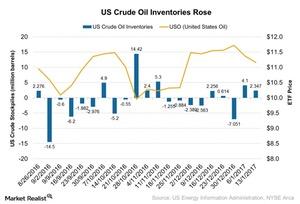

How Will Rise in Crude Oil Inventories Affect Crude Oil Movement?

According to the EIA’s (US Energy Information Administration) report on January 18, 2017, US crude oil inventories rose ~2.35 MMbbls (million barrels) for the week ended January 13, 2017.

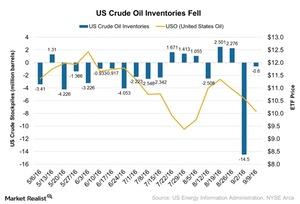

How OPEC’s Decision Will Impact Crude Oil’s Movement

According to the EIA’s (U.S. Energy Information Administration) report on September 14, 2016, US crude oil inventories fell 0.6 MMbbls (million barrels) for the week ending September 9.

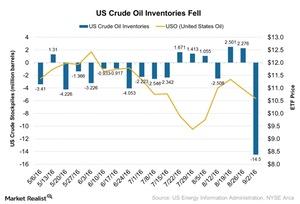

Crude Oil Prices Jumped as Inventories Fell

According to the EIA’s report on September 8, 2016, US crude oil inventories fell by 14.5 MMbbls for the week ended on September 2, 2016.

Why US Crude Oil Inventories Fell for 9th Consecutive Week

According to the July 20, 2016, U.S. Energy Information Administration report, US crude oil inventories declined by 2.3 MMbbls for the week ended July 15, 2016.

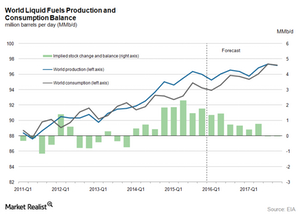

Crude Oil Supply and Demand Gap: Will It Narrow or Widen?

The consensus of slowing US crude oil production will continue to narrow the supply and demand gap as long as demand stays steady.

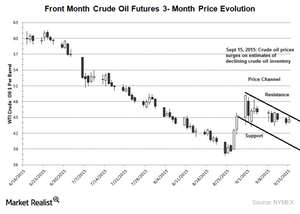

Crude Oil Prices Are Trading in a Downward Trending Range

October WTI crude oil futures rose for the first time after falling for two consecutive days. Slowing US crude oil production is driving crude oil prices.