Analyzing US Gasoline Inventories and Gasoline Demand

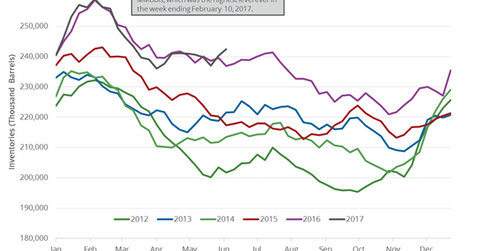

US gasoline inventories rose by 2.1 MMbbls to 242.3 MMbbls on June 2–9, 2017. Inventories rose 0.9% week-over-week and 2.3% year-over-year.

June 15 2017, Published 11:04 a.m. ET

US gasoline inventories

The EIA (U.S. Energy Information Administration) reported that US gasoline inventories rose by 2.1 MMbbls (million barrels) to 242.3 MMbbls on June 2–9, 2017. Inventories rose 0.9% week-over-week and 2.3% year-over-year. A surprise build in US gasoline inventories pressured gasoline futures on June 14, 2017. Gasoline futures fell 4.5% to $1.433 per gallon on the same day. As a result, US crude oil (FENY) (PXI) (IEZ) futures fell on June 14, 2017. Gasoline inventories are above the five-year average. Gasoline inventories also weighed on gasoline and crude oil prices.

US gasoline demand

The EIA estimates that US gasoline demand fell by 0.5% to 9,269,000 bpd (barrels per day) on June 2–9, 2017. US gasoline demand fell 5% from the same period in 2016. Lower gasoline demand impacts inventories. High inventories have a negative impact on gasoline and crude oil prices. Lower gasoline and crude oil prices have a negative impact on refiners and oil producers’ earnings like Valero (VLO), Comstock Resources (CRK), and Northern Oil & Gas (NOG).

US gasoline consumption estimates for 2017

The EIA estimates that US gasoline consumption will average 9,340,000 bpd in 2017. It also estimates that US gasoline consumption will average 9,370,000 bpd 2018. US gasoline consumption could hit a record in 2018.

Impact of gasoline inventories and gasoline demand

US gasoline inventories are 6.3% below their all-time high. The expectation of a fall in gasoline inventories could support gasoline prices. The expectation of record gasoline demand this summer could also support gasoline prices. High gasoline prices could push crude oil prices higher.

In the next part of this series, we’ll take a look at US distillate inventories.