WTI Crude Oil and Gasoline Futures Diverge

US gasoline futures contracts for June delivery fell 0.1% to $1.60 per gallon on May 17, 2017. Prices fell due to a lower fall in US gasoline inventories.

May 18 2017, Published 9:44 a.m. ET

US gasoline futures

US gasoline futures contracts for June delivery fell 0.1% to $1.60 per gallon on May 17, 2017. Prices fell due to the less-than-expected fall in US gasoline inventories. We’ll look at gasoline inventories in the next part of this series.

Gasoline and crude oil (ERY) (IEZ) (USL) futures diverged on May 17, 2017. For more on crude oil prices, read Part 1 of this series.

Highs and lows

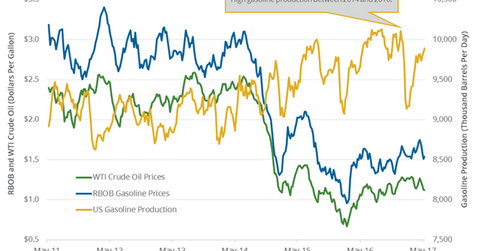

On February 26, 2016, US gasoline active futures contracts hit a low of ~$1 per gallon—the lowest level in 12 years. Prices fell due to falling crude oil (XLE) (XOP) prices and strong gasoline production between 2014 and 2016, as you can see in the above chart. As of May 17, 2017, gasoline active futures have risen 60% from their lows in early 2016 due to the increase in gasoline demand and rise in crude oil prices in 2016.

Higher gasoline and crude oil prices have a positive impact on US refiners and oil producers such as Western Refining (WNR), Phillips 66 (PSX), Swift Energy (SFY), and Goodrich Petroleum (GDP).

On April 12, 2017, prices hit $1.77 per gallon—the highest level since August 2015. As of May 17, 2017, gasoline active futures are 10% below their highs due to the fall in gasoline demand.

In the next part of this series, we’ll take a look at US gasoline inventories and how they impact gasoline and oil prices.