Why Most Analysts Are Calling Marathon Petroleum a ‘Buy’

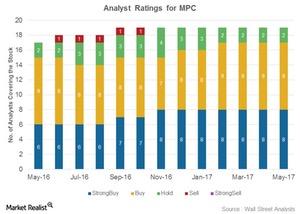

Marathon Petroleum (MPC) has been rated by 19 Wall Street analysts. Seventeen analysts (or 89%) have rated it as a “buy” so far in May 2017.

Nov. 20 2020, Updated 3:54 p.m. ET

Most analysts call Marathon Petroleum a “buy”

Marathon Petroleum (MPC) has been rated by 19 Wall Street analysts. Seventeen analysts (or 89%) have rated it as a “buy” so far in May 2017. Another two analysts have rated it as a “hold.”

MPC’s mean price target of $62 per share implies a rise of ~18% from its current level. Compared to May 2016, MPC’s ratings have strengthened with more “buys.”

Peers’ ratings

MPC’s peers Tesoro (TSO), Valero Energy (VLO), and Phillips 66 (PSX), have been rated as “buys” by 67%, 57%, and 21% of analysts, respectively. Other smaller players Delek US Holdings (DK), Alon USA Energy (ALJ), and Western Refining (WNR) have been rated as “buys” by 33%, 11%, and 17% of analysts, respectively.

For exposure to small-cap stocks, you can consider the iShares Russell 2000 Value ETF (IWN). The ETF has ~5% exposure to energy sector stocks, including DK, WNR, and ALJ. For exposure to big US companies, you can look to the iShares Core S&P 500 ETF (IVV) and the SPDR Dow Jones Industrial Average ETF (DIA). These ETFs have ~6% exposure each to energy sector stocks. IVV also contains MPC, VLO, TSO, and PSX in its portfolio.

Marathon Petroleum in the midst of reorganization

Marathon Petroleum plans to restructure its organization to unlock value. MPC has already started working on this initiative by executing dropdowns in 1Q17. In the quarter, MPC dropped down certain pipelines, terminals, and storage assets to its MLP, MPLX (MPLX), for $2 billion.

The restructuring plan broadly includes the dropdown of midstream assets to MPLX LP, the exchange of economic interest in MPC’s GP (general partner) and IDRs (incentive distribution rights) for new MPLX LP units, and the separation of MPC’s Speedway segment. To know more about IDRs, read IDRs: How Do They Impact MLPs?

In MPC’s 1Q17 earnings press release, Gary R. Heminger, its chair, president, and CEO, said, “We look forward to the completion of the dropdowns and the exchange of our general partner economic interests for newly issued MPLX common units. These actions are designed to unlock the value inherent in our midstream platform and to provide the ongoing return of capital to shareholders in a manner consistent with maintaining an investment-grade credit profile.”

Analysts likely expect this restructuring to unlock value for MPC. No wonder the majority of analysts rate it as a “buy.”