US Distillate Inventories Fell for the Third Straight Week

The EIA reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 146.8 MMbbls on May 5–12, 2017.

Nov. 20 2020, Updated 11:15 a.m. ET

US distillate inventories

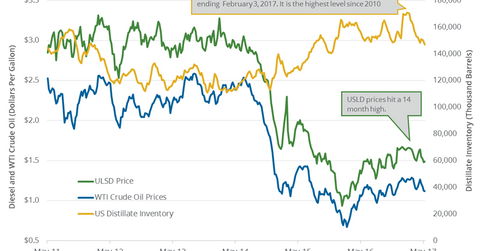

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 146.8 MMbbls on May 5–12, 2017. Surveys estimated that US distillate inventories would have fallen by 1.05 MMbbls for the same period. US distillate inventories fell for the third straight week.

June diesel futures contracts rose 1.1% to $1.53 per gallon on May 17, 2017. Prices rose due to the larger-than-expected fall in distillate inventories. Crude oil (FENY) (DIG) (XLE) (FXN) and diesel futures moved in the same direction on May 17, 2017.

Diesel prices usually move together with crude oil prices, as shown in the following chart. The rollercoaster ride in crude oil and diesel fuel prices impacts US refiners and crude oil producers’ earnings like Phillips 66 (PSX), Tesoro (TSO), QEP Resources (QEP), and Cobalt International Energy (CIE). For more on crude oil prices, read Part 1 of this series.

Distillate production and demand

US distillate production rose by 86,000 bpd (barrels per day) to 5,042,000 bpd on May 5–12, 2017. US distillate imports rose by 46,000 bpd to 161,000 bpd for the same period. Weekly distillate demand rose by 76,000 bpd to 4,215,000 bpd during the same period.

Impact

US distillate inventories hit 170.7 MMbbls in the week ending February 3, 2017—the highest level since 2010. Since then, they have fallen ~14%. Falling distillate inventories are bullish for diesel and crude oil prices.

For more on crude oil prices, read Hedge Funds Bearish on Crude despite Possible Russia-OPEC Deal and Key Price Drivers for Crude Oil Bulls and Bears.

Read Will Crude Oil Prices Test 3 Digits Again? for more on crude oil price forecasts.

For related analysis, visit Market Realist’s Energy and Power page.