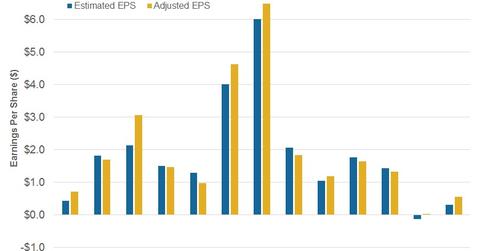

Tesoro Beats 1Q17 Earnings

Tesoro (TSO) posted its 1Q17 results on May 8, 2017. Revenues missed analysts’ estimate, but adjusted EPS of $0.55 surpassed the estimate of $0.31.

May 11 2017, Updated 7:28 a.m. ET

Tesoro’s 1Q17 estimated and actual performance

Tesoro (TSO) posted its 1Q17 results on May 8, 2017. Here are the results:

- Revenues of $6.6 billion missed Wall Street analysts’ estimates.

- Adjusted EPS (earnings per share) was $0.55, surpassing the estimate of $0.31 but coming in 54.0% lower than 1Q16.

1Q17 earnings review

Tesoro’s net income attributable to its shareholders from continuing operations fell from $58.0 million in 1Q16 to $50.0 million in 1Q17. That included $19.0 million of pre-tax expenses related to acquisitions.

However, TSO’s operating income rose 25.0% YoY (year-over-year) to $317.0 million. The rise was due to a YoY increase in operating income for two of its three segments: Refining and Tesoro Logistics LP (TLLP), its subsidiary and logistics operating segment. They were partially offset by a YoY fall in operating income for the Marketing segment.

Income in 1Q17 for the Refining segment swung to a profit of $34.0 million compared to a loss in 1Q16. That was due to a higher gross refining margin coupled with higher throughput. We’ll look at Tesoro’s margins in the next part.

TLLP’s operating income in 1Q17 rose 26.0% YoY to $150.0 million due to higher average revenue per unit in its terminaling and gas gathering and processing subsegments. The average margin on NGL (natural gas liquids) sales per barrel also rose YoY in 1Q17. In addition, gas gathering and processing throughput, crude oil and water gathering volumes, terminaling throughput, and pipeline transportation throughput all rose in 1Q17 over 1Q16.

Operating income for TSO’s Marketing segment fell to $133.0 million, which was 41.0% lower than 1Q16. Lower income was due to a fall in fuel sales volumes impacted by weather conditions in California. Tesoro’s retail stations increased 3.0% YoY to 2,513 in 2017.

Peer performances in 1Q17

Let’s see how Tesoro’s peers fared in 1Q17 compared to 1Q16:

- Valero Energy (VLO): 13.0% rise in EPS

- Marathon Petroleum (MPC): earnings unchanged from 1Q16

- Western Refining (WNR): 46.0% rise in EPS

- Delek US Holdings (DK): swung to a profit from a loss

- Phillips 66 (PSX): 16.0% fall in adjusted EPS

- PBF Energy (PBF): posted a loss

- HollyFrontier (HFC): posted a loss

For exposure to smaller value stocks, you can consider the iShares Russell 2000 Value (IWN) (RUT-INDEX). IWN has a ~5.0% exposure to energy sector stocks, including DK and WNR.