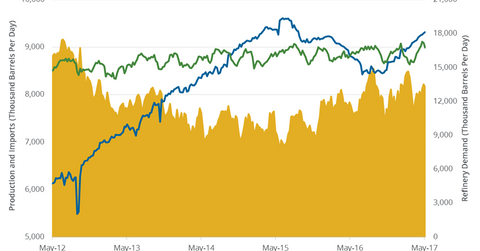

Fall in US Refinery Demand and Imports Impacted Inventories

US refineries operated at 91.5% of their operable capacity in the week ending May 5, 2017. The US refinery demand fell for the second consecutive week.

Nov. 20 2020, Updated 1:01 p.m. ET

US refinery demand

The EIA (U.S. Energy Information Administration) reported that US refinery crude oil demand fell by 418,000 bpd (barrels per day) to 16,759,000 bpd between April 28, 2017, and May 5, 2017. US refinery crude oil demand fell 2.4% week-over-week, but rose 3.5% YoY (year-over-year). US refinery demand hit 17,285,000 bpd for the week ending April 21, 2017—the highest level ever.

US refineries operated at 91.5% of their operable capacity in the week ending May 5, 2017. US refinery demand fell for the second consecutive week. The fall in refinery demand is bearish for crude oil (PXI) (USL) (ERY) prices. For more on crude oil prices, read Part 1 of this series. Lower crude oil prices have a negative impact on oil producers’ earnings like Comstock Resources (CRK), Hess (HES), Apache (APA), and Triangle Petroleum (TPLM).

US crude oil imports

The EIA reported that US crude oil imports fell by 644,000 bpd to 7,620,000 bpd between April 28, 2017, and May 5, 2017. Imports fell 7.8% week-over-week and 0.4% YoY.

US crude oil inventories

The fall in US crude oil imports and refinery demand between April 28, 2017, and May 5, 2017, would have likely led to the fall in inventories. The rise in US crude oil production for the same period could have limited the fall in inventories. A rise in exports could have also contributed to the fall in inventories. Read Are US Crude Oil Exports Game Changers for the Crude Oil Market? for more on US crude oil exports. For more on US production, read the previous part of this series. For more on US crude oil inventories, read Part 2 of this series.

In the next part, we’ll take a look at US gasoline prices and how they impact crude oil prices.