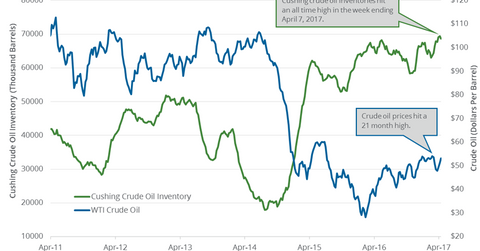

Cushing Crude Oil Inventories Fell from an All-Time High

For the week ending April 14, 2017, the EIA reported that Cushing crude oil inventories fell by 0.8 MMbbls (million barrels) to 68.6 MMbbls.

April 25 2017, Published 5:31 a.m. ET

Cushing crude oil inventories

Market surveys estimate that Cushing crude oil inventories rose on April 14–21, 2017. A rise in crude oil inventories at Cushing could pressure US crude oil (DIG) (XES) (BNO) prices.

Lower crude oil prices will have a negative impact on crude oil producers’ earnings such as Continental Resources (CLR), Sanchez Energy (SN), and Goodrich Petroleum (GDP).

EIA’s crude oil inventory report

On April 26, 2017, at 10:30 AM EST, the EIA (U.S. Energy Information Administration) will release its crude oil inventory report for the week ending April 21, 2017.

For the week ending April 14, 2017, the EIA reported that Cushing crude oil inventories fell by 0.8 MMbbls (million barrels) to 68.6 MMbbls—compared to the previous week. Inventories fell 1.1% week-over-week, but rose 6.7% year-over-year.

Cushing’s storage capacity

Cushing, Oklahoma, is the delivery point for crude oil futures contracts trading on NYMEX. It’s also the largest crude oil storage hub in the US. Cushing’s crude oil storage capacity is 73 MMbbls.

Impact

As you can see in the above graph, crude oil (VDE) (USO) (UCO) prices and inventories have an inverse relationship. Cushing crude oil inventories hit the highest level of 69.4 MMbbls in the week ending April 7, 2017. Inventories have risen by ~10 MMbbls, or ~16%, in the last 21 weeks. Near-record Cushing crude oil inventories could pressure crude oil prices.

Next, we’ll analyze the US crude oil rig count last week.