What US Crude Oil Inventories Mean for Oil

The EIA reported that US crude oil inventories fell by 2.7 MMbbls (million barrels) to 509.1 MMbbls on June 9–16, 2017.

June 22 2017, Published 11:13 a.m. ET

Crude oil prices

August West Texas Intermediate crude oil (VDE) (RYE) (SCO) futures contracts fell 0.1% to $42.5 per barrel in electronic trade at 1:50 AM EST on June 22, 2017.

Prices have fallen~19% in the past year. They have fallen ~17.5% since OPEC’s meeting. Moves in crude oil prices impact oil producers like ConocoPhillips (COP), Chevron (CVX), Stone Energy (SGY), and Denbury Resources (DNR).

EIA’s crude oil inventories

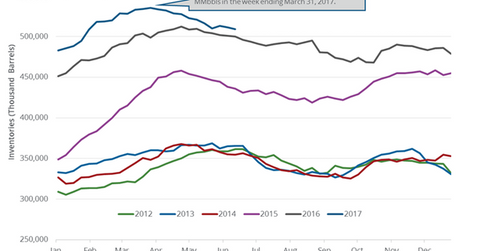

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on June 21, 2017. It reported that US crude oil inventories fell by 2.7 MMbbls (million barrels) to 509.1 MMbbls on June 9–16, 2017.

A Reuters survey estimated that US crude oil inventories could have fallen by 2.1 MMbbls for the same period. A larger-than-expected fall in US crude oil inventories didn’t support oil prices on June 21, 2017. Prices fell due to oversupply concerns and bearish drivers, which we covered in Part 1 of this series.

Cushing crude oil inventories also fell by 1.08 MMbbls on June 9–16, 2017. Crude oil prices fell despite the fall in US and Cushing inventories.

Seasonality

US crude oil inventories usually fall at this time of the year. Inventories have fallen 0.5% for the week ending June 16, 2017—compared to the previous week. Inventories have risen 1.8% year-over-year.

US crude oil inventories fell by 0.9 MMbbls on June 9–16, 2016. The five-year average decline is at 1.3 MMbbls during this period.

Impact of global and US crude oil inventories

US crude oil inventories have fallen by 24.8 MMbbls in the last ten weeks. Saudi Arabia could impact US inventories. However, US and global inventories are above the five-year average, which could weigh on crude oil prices.

If prices continue to fall, OPEC might consider deeper production cuts in the near future. On June 20, Iran’s oil minister said that deeper production cuts are possible.

In the next part, we’ll look at US crude oil output.