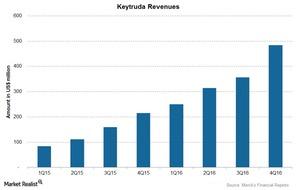

Merck’s Keytruda Saw Impressive Growth in 2016

Keytruda, a prescription medicine classified under Merck’s (MRK) immunooncology franchise, is used to treat non-small cell lung cancer as well as melanoma.

March 27 2017, Updated 9:08 a.m. ET

Keytruda

Keytruda, a prescription medicine classified under Merck’s (MRK) immunooncology franchise, is used to treat non-small cell lung cancer as well as melanoma, a type of skin cancer. Merck launched Keytruda in 4Q14 and reported global sales of $1.4 million for 2016, a ~148% growth in revenues as compared to $566 million in 2015.

Uses

Keytruda is used for the treatment of melanoma that has spread or cannot be removed by surgery (advanced melanoma) when ipilimumab didn’t work or is no longer working and the tumor has an abnormal “BRAF” gene.

Keytruda is also used for non-small cell lung cancer (or NSCLC) under certain conditions. Recently, the US Food and Drug Administration (or FDA) approved the supplemental biologics license application for Keytruda for use as first-line treatment for patients with metastatic NSCLC with high PD-L1 expressions, but no “EGFR” or “ALK” gene abnormalities.

Keytruda is also approved for the treatment of recurrent or metastatic squamous cell carcinoma of the head and neck (or HNSCC) for patients who have undergone platinum-contained chemotherapy.

Geographical reach

In the US, Keytruda has ~70% of the anti-PD-1 patient share in melanoma and is the number one therapy for melanoma in the US across all classes of treatment.

Outside the US, Merck has already launched Keytruda in almost 40 markets including the European Union. Keytruda is approved for advanced first-line and second-line melanoma in the EU.

Overall, Keytruda’s clinical development program has performed studies on more than 30 tumor types in more than 160 clinical trials, which include over 80 combinations of Keytruda with other cancer treatments.

Some of the EGFR inhibitors used to treat various types of cancer include Iressa from AstraZeneca (AZN), Tykerb from Novartis (NVS), Erbitux from Eli Lilly (LLY), and Vectibix from Amgen (AMGN). To divest the risk, investors can consider ETFs like the Vanguard Health Care ETF (VHT), which holds 5.3% of its total assets in Merck.