How Merck’s Segments Performed in 2016

Merck (MRK) reported a 1% increase in its revenues to $39.8 billion in 2016.

March 27 2017, Updated 7:38 a.m. ET

Merck’s 2016 revenue

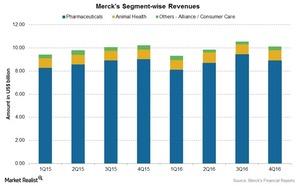

Merck (MRK) reported a 1% increase in its revenues to $39.8 billion in 2016. The company reported operational growth of 3% for 2016, partially offset by the 2% negative impact of foreign exchange. For full-year 2016, the company reported revenues of $39.8 billion, a 1% growth in revenues as compared to about $39.5 billion in 2015.

The above graph shows the segment-wise revenues of Merck in each quarter over the last two years. Because the company has operations in over 100 countries, and ~55% of its total revenue comes from sales outside US markets, the company is very exposed to currency risk. The impact of foreign exchange on the company’s revenues has led to negative growth in absolute figures.

Pharmaceuticals

The global human health segment (or pharmaceuticals), the highest revenue-generating segment, contributed nearly 88.3% of total revenues for 2016 as compared to 88.1% of total revenues for 2015. This segment includes various franchises like oncology, vaccines, hospital acute care, diabetes, and women’s health.

The pharmaceuticals segment has several blockbuster drugs with a yearly contribution of over $1 billion each. These drugs include Januvia, Janumet, Zetia, Vytorin, Remicade, Isentress, Gardasil, Proquad/Varivax, and Cubicin.

The competitors for Januvia and its combination version Janumet are Onglyza, jointly made by Bristol-Myers Squibb (BMY) and AstraZeneca (AZN), and Galvus from Novartis (NVS). The competitors for Zetia include Niaspan from AbbVie (ABBV) and Lipitor from Pfizer (PFE).

Animal health

The animal health segment’s contribution rose to 8.7% of total revenues for 2016 as compared to 8.4% for 2015. Increased revenues from companion animal products including Bravecto and new aqua and swine products are driving growth in this segment.

Merck’s animal health segment competes with companies including Zoetis (ZTS) and Eli Lilly (LLY). To divest the risk, investors can consider ETFs like the iShares S&P 500 Growth ETF (SPYG), which holds ~1% of its total assets in Merck.