Nordic American Tankers’ Long Dividend History Continued

Nordic American Tankers has a long history of paying dividends—77 consecutive quarters to date. It declared a cash dividend of $0.26 per share on October 27.

Nov. 16 2016, Updated 10:04 a.m. ET

Cash flow

Operating cash flow represents the cash flow from a company’s core operations. Nordic American Tankers’ (NAT) operating cash flow in 3Q16 was $21.7 million—compared to $40.7 million in the previous quarter and $49.1 million in 3Q16.

Dividends

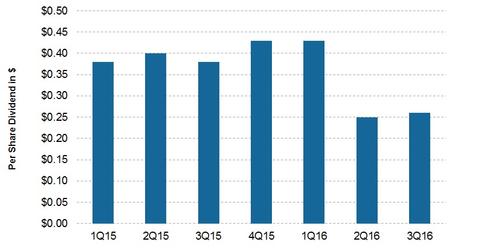

Nordic American Tankers claims to have a unique business model with a high dividend payout and low financial risk. The company has a long history of paying dividends—77 consecutive quarters to date. The company declared a cash dividend of $0.26 per share on October 27, 2016. The cash dividend was paid on November 10. The last dividend was $0.25 per share. The dividend was $0.38 per share in 3Q15.

Future dividends

Nordic American Tankers has three newbuids in the pipeline. The company thinks that newbuilds will join the fleet and sustainably increase the company’s dividend capacity.

Dividend yield

Nordic American Tankers’ average annual dividend yield is 12% since the beginning of its operations in 1997. It had a dividend yield of 11.6% as of November 14, 2016. The dividend yields for other crude tankers are:

- DHT Holdings’ (DHT) dividend yield is 2.2%.

- Teekay Tankers’ (TNK) dividend yield is 4.9%.

- Tsakos Energy Navigation’s (TNP) dividend yield is 6.9%.

- Euronav (EURN) dividend yield is 18.9%.

- Navios Maritime Midstream Partners’ (NAP) dividend yield is 16.1%.

Investors who are interested in broad exposure to industrials can invest in the SPDR Dow Jones Industrial Average ETF (DIA).