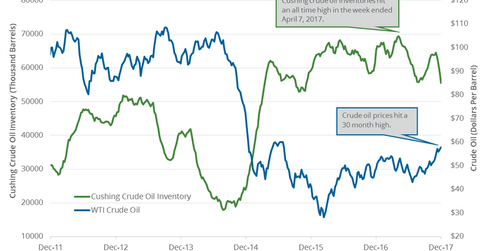

Cushing Oil Inventories Are near November 2015 Low

The EIA estimated that Cushing’s crude oil inventories fell by 2,753,000 barrels or 4.7% to 55.5 MMbbls (million barrels) on November 24–December 1, 2017.

Nov. 20 2020, Updated 11:54 a.m. ET

Cushing oil inventories

Cushing, Oklahoma, is the largest storage hub in the US for crude oil inventories. The market estimated that Cushing crude oil inventories would fall on December 1–8, 2017. Any fall in Cushing oil inventories could have a bullish impact on oil (DBO) (DWT) prices.

Crude oil (DTO) (OIL) prices are near a 30-month high. Higher oil prices benefit energy ETFs like the Fidelity MSCI Energy Index (FENY) and the First Trust Energy AlphaDEX Fund (FXN).

EIA’s Cushing inventories

The EIA estimated that Cushing’s crude oil inventories fell by 2,753,000 barrels or 4.7% to 55.5 MMbbls (million barrels) on November 24–December 1, 2017. The inventories fell by 11,369,000 barrels or 17% from the same period in 2016. The inventories fell due to the Keystone oil pipeline shutting down. The pipeline restarted on November 28, 2017. Cushing inventories were near the lowest level since November 2015. Any fall in the inventories has a positive impact on oil (USL) (SCO) prices. Higher oil prices support oil producers’ (IEO) (IXE) earnings like Stone Energy (SGY), Anadarko Petroleum (APC), PDC Energy (PDCE), and Chevron (CVX).

EIA’s US crude oil inventories

US crude oil inventories fell by 5.6 MMbbls to 448.1 MMbbls on November 24–December 1, 2017. Inventories fell 1.2% week-over-week and by 37 MMbbls or 7.7% from the same period in 2016.

US and Cushing oil inventories

Nationwide crude oil inventories fell 16% from their peak. Cushing oil inventories fell ~22% from their peak. The fall in nationwide and Cushing oil inventories could help oil (USO) prices.

Next, we’ll discuss the US crude oil rig count.