US Natural Gas Inventories Pressure Prices

The EIA reported that US natural gas inventories rose by 54 Bcf to 2,115 Bcf on April 7–14, 2017. Inventories rose 2.6% week-over-week but fell 14.8% YoY.

April 21 2017, Published 10:04 a.m. ET

EIA’s natural gas inventories

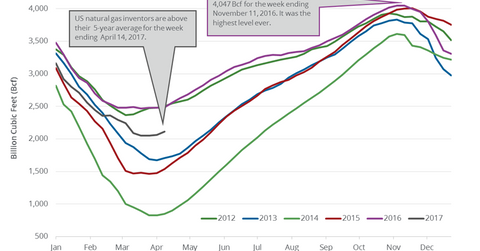

The EIA (U.S. Energy Information Administration) released its weekly natural gas inventory report on April 20, 2017. It reported that US natural gas inventories rose by 54 Bcf (billion cubic feet) to 2,115 Bcf on April 7–14, 2017. Inventories rose 2.6% week-over-week but fell 14.8% YoY (year-over-year). The YoY fall in inventories is bullish for natural gas (FCG) (UGAZ) (DGAZ) prices.

However, US natural gas inventories hit 4,047 Bcf for the week ending November 11, 2016—the highest level ever. Inventories fell ~46% from their peak level. Changes in inventories impact natural gas prices. For more on natural gas prices and the weather, read Part 1 and Part 2 of this series.

A Wall Street Journal survey estimated that US natural gas inventories would have risen by 49 Bcf on April 7–14, 2017.

A larger-than-expected rise in natural gas inventories pressured natural gas (UNG) (BOIL) prices on April 20, 2017. The five-year average natural gas addition for this period is 35 Bcf. Natural gas inventories rose by 6 Bcf during the same period in 2016. They rose by 10 Bcf in the week ending April 7, 2017.

Changes in natural gas prices impact oil and gas producers’ profitabilities such as Range Resources (RRC), Southwestern Energy (SWN), Newfield Exploration (NFX), and Memorial Resource Development (MRD).

What’s the impact?

For the week ending April 14, 2017, US natural gas inventories were 15.4% higher than their five-year average. They were 21.0% higher than their five-year average in early March 2017. The expectation of slowing inventories could support natural gas prices in 2Q17 and 2017.

Next, let’s take a look at US natural gas inventories by region. We’ll also look at the US natural gas inventory forecast for October 2017.