Will Oil Producers’ Meeting Support Crude Oil Prices in September?

OPEC producers will be meeting at an energy forum in Algeria from September 26–28, 2016. Crude oil prices are up by 16% so far in August 2016.

Nov. 20 2020, Updated 4:51 p.m. ET

Oil producers’ meeting

OPEC (Organization of the Petroleum Exporting Counties) producers will be meeting at an energy forum in Algeria from September 26–28, 2016. Crude oil prices are up by 16% so far in August 2016, partially due to speculation of oil producers’ meeting. It’s meant to freeze their output.

Iran, Saudi Arabia, and Russia’s comments early in August suggest that major oil producers are trying to support oil prices.

Saudi Arabia

On August 25, 2016, Saudi Arabia’s energy minister, Khalid al-Falih, said that the oil market is balancing out and any “significant intervention” isn’t required. This suggests that Saudi Arabia may not make a major contribution at the oil producers’ meeting.

Iran

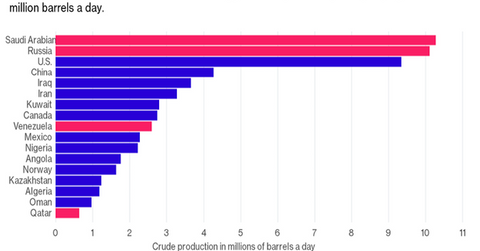

Iran is the third-largest crude oil producer among OPEC countries. Iran stressed that it would support oil producers’ meeting after it achieved its crude oil production target to pre-sanctions levels of 4 MMbpd (million barrels per day).

Iran produced 3.6 MMbpd of crude oil in July 2016. It exported more than 2 MMbpd of crude oil in June 2016, according to data from the Joint Organisations Data Initiative.

Read Crude Oil Producers’ Meeting: Is It Smoke without Fire? for more analysis. You can also read OPEC’s Crude Oil Production Rose, Bearish for the Oil Market, Decoding OPEC Members’ Crude Production in July 2016, Russia’s High Crude Oil Production Is Negative for Crude Oil Prices, and How the US Could Be the Next Saudi Arabia of the Crude Oil Market.

Impact on stocks and ETFs

The rollercoaster ride in crude oil prices impacts oil and gas producers’ profitability such as WPX Energy (WPX) and Goodrich Petroleum (GDP). It also impacts funds such as the Vanguard Energy ETF (VDE), the DB Crude Oil Double Short ETN (DTO), the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), the Direxion Daily Energy Bear 3x (ERY), and the Guggenheim S&P 500 Equal Weight Energy ETF (RYE).

In the next part of the series, we’ll look at Cushing crude oil inventories.