Crude Oil Supply and Demand Gap: Will It Narrow or Widen?

The consensus of slowing US crude oil production will continue to narrow the supply and demand gap as long as demand stays steady.

March 8 2016, Published 2:23 p.m. ET

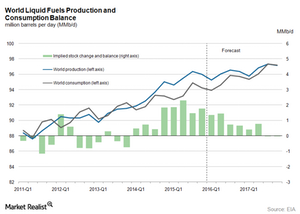

Crude oil supply and demand gap

The EIA (U.S. Energy Information Administration) forecasts that the global crude oil supply and demand gap will average around 290,000 bpd (barrels per day) in 2017. But, the IEA (International Energy Agency) estimates that the global crude oil supply and demand gap will be around zero by the end of 2017. The EIA is scheduled to release its monthly Short-Term Energy Outlook report on March 8, 2016. The consensus of slowing US crude oil production will continue to narrow the supply and demand gap as long as demand stays steady. So, the narrowing of the supply and demand gap over the long term could benefit crude oil prices.

Crude oil inventories

The EIA reports that global crude oil inventories rose by 1.8 MMbpd (million barrels per day) in 2015. Global crude oil inventories rose for the second straight year due to massive production by the US and Canada in 2014 and 2015. The EIA added that global crude oil inventories are expected to rise by 1 MMbpd in 2016. The inventories will likely increase by 0.3 MMbpd in 2017. The IEA estimates that global inventories are at 3 billion barrels as of January 2016. The consensus of the rising crude oil inventory will limit the upside for crude oil prices in the short term. We’ll discuss the long-term crude oil price forecast in the next part of the series.

The volatility in crude oil prices impacts oil producers like QEP Resources (QEP), Synergy Resources (SYRG), Range Resources (RRC), WPX Energy (WPX), Hess (HES), and PDC Energy (PDCE). It also impacts ETFs and ETNs like the iShares U.S. Energy ETF (IYE), the iShares U.S. Oil Equipment & Services ETF (IEZ), and the VelocityShares 3x Long Crude Oil ETN (UWTI).