Category Flows: ETF Construction Matters!

The iShares Core S&P Total U.S. Stock Market ETF (ITOT) saw by far the largest inflows within our ETF universe last week.

July 25 2016, Published 9:49 a.m. ET

Inflows: Broad US exposure favored

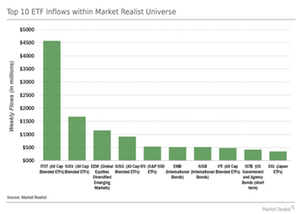

The iShares Core S&P Total U.S. Stock Market ETF (ITOT) saw by far the largest inflows within our ETF universe last week. Investors poured a total ~$4.6 billion into the fund. Remarkably, this amount represents ~80% of total year-to-date inflows into ITOT. The iShares Core U.S. Value ETF (IUSV) ranked second, hovering close to its all-time highs. Outside the United States, the iShares MSCI Emerging Markets ETF (EEM) also saw notable inflows of ~$1.2 billion, reflecting the continued chase for yield as the chart below shows.

The standout of the week was arguably the broad-based US equity index ETF (ITOT). In fact, the massive inflows reflect an important change in investor thinking, especially within the theme of selective optimism. Note that SPDR’s S&P 500 ETF Trust (SPY) usually claimed the top spot in terms of inflows over the last few weeks. However, with US equities trading at extremes, market participants are starting to carefully pick apart ETF structures, seeking diversification and cost-savings.

ITOT is well diversified with a portfolio of over 3,700 holdings, reducing top-heaviness in any one security or industry. SPY’s ~500 holdings are no match. In terms of fees, ITOT also has the upper hand, reflecting in an expense ratio of 0.03%, which is much lower than SPY’s expense ratio of 0.095%.

So it seems that more and more investors are paying close attention to structural ETF features in order to boost returns and reduce risks.

Outflows: No love for Europe or high-risk US equities

The avoidance of high-beta US equity exposure that we discussed in Part 1 and Part 2 of this series extends to the larger ETF universe, highlighting the importance of selective optimism. You can see this trend in PowerShares’ QQQ Trust (QQQ) and iShares’ Russell 2000 ETF (IWM) witnessing the largest outflows within our ETF universe as the chart below shows.

As you can see, investors also continued to reduce their exposure to Europe. Vanguard’s FTSE Europe ETF (VGK) saw sizable outflows of ~$870 million last week while barely breaking even from a return perspective. You mas ask why market participants avoided VGK in particular. Examining the ETF’s geographical exposure, we see that the United Kingdom contributes a whopping ~27%, reflecting still-elevated worries about the United Kingdom’s political and economic future.

Plus, competing ETFs are far less exposed to the United Kingdom, best illustrated by iShares’ MSCI Eurozone ETF (EZU), which weighs the country merely at ~3%. This point is further illustrated by considering the ~$500 million that left the Deutsche X-trackers MSCI EAFE Hedged Equity ETF (DBEF) as the fund’s ~17% exposure to the United Kingdom can be considered significant. Similar to our comparison between ITOT and SPY, you can see the importance of analyzing ETF structural features again.

In Part 4 of this series, we’ll look at country ETF flows in isolation.