iShares Core US Value

Latest iShares Core US Value News and Updates

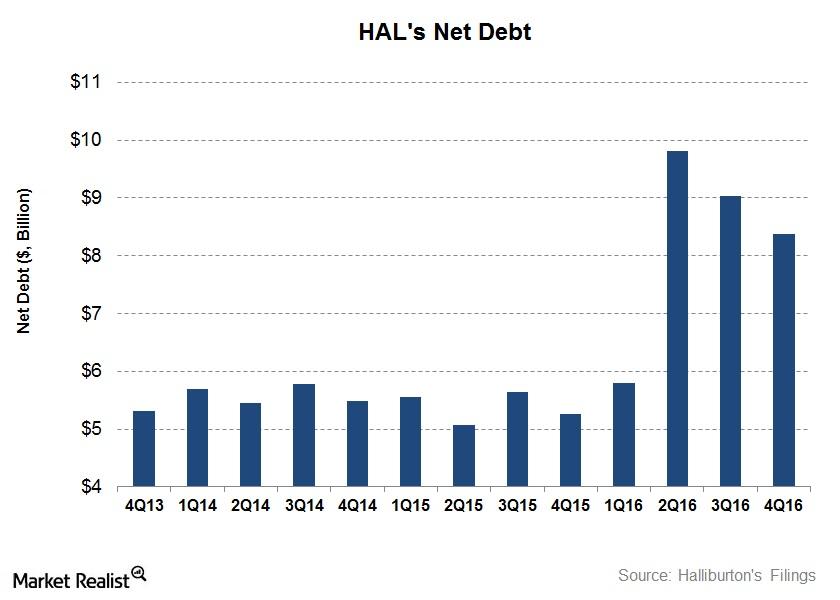

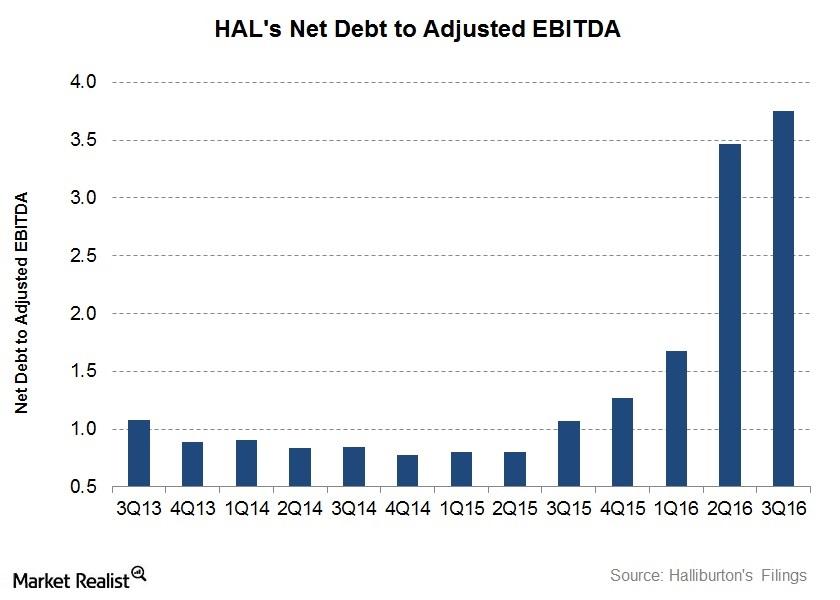

A Look at What’s Happening to Halliburton’s Debt

In 4Q16, Halliburton’s total debt fell 19% compared to a year earlier, and its cash and marketable securities fell 60%. In effect, its net debt rose 59% to ~$8.4 billion as of December 30, 2016.

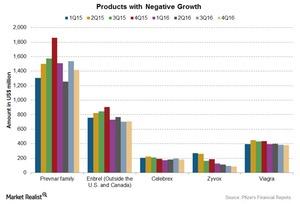

These Pfizer Products Saw Declining Revenues in 2016

The overall share of revenues for the Essential Health Products business fell marginally to 44.7% of the total revenues for 2016 from 45.2% of the total revenues for 2015.

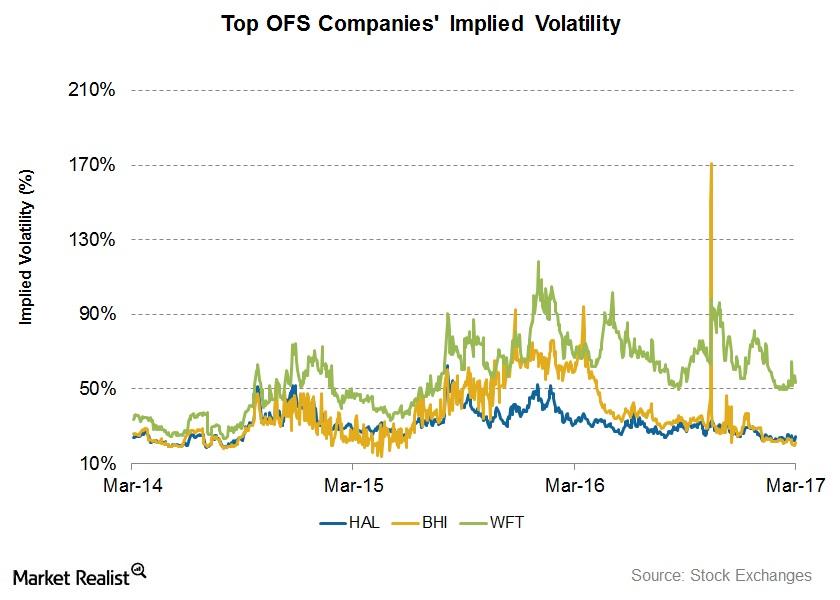

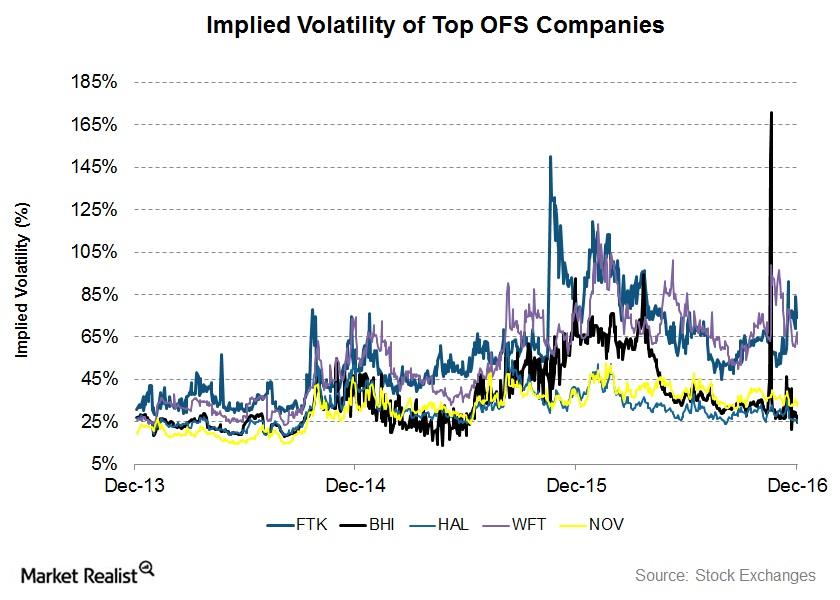

How Volatile Are the Top Oilfield Services Companies?

In this part of the series, we’ll compare the implied volatilities of the top OFS companies as rated by Wall Street analysts for 1Q17.

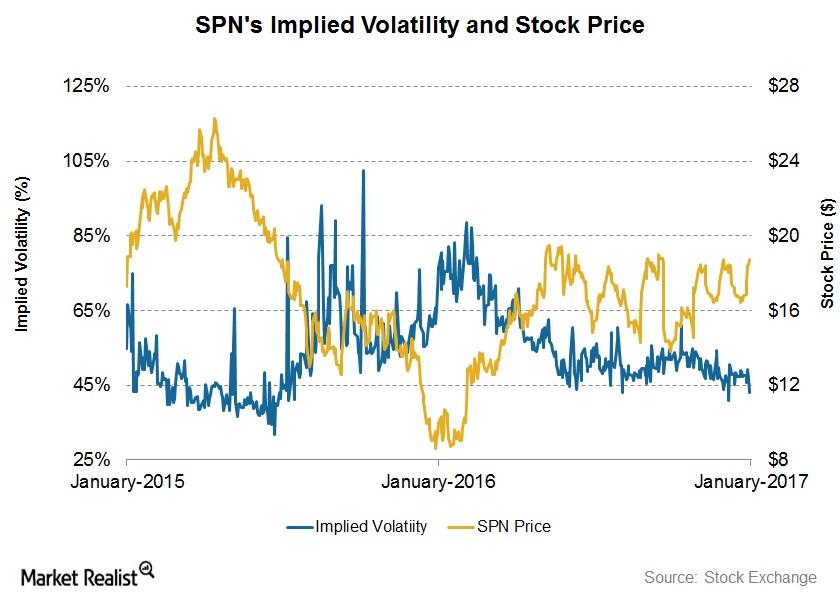

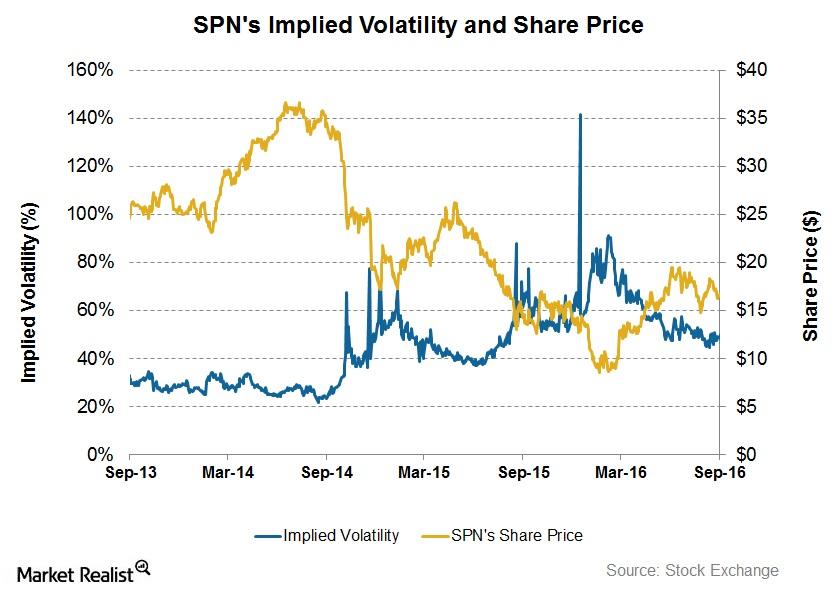

How Volatile Is Superior Energy Services in 1Q17?

On January 6, SPN had an implied volatility of ~43%. Since SPN’s 3Q16 financial results on October 24, 2016, its implied volatility has fallen from 54%.

Top Oilfield Service Stocks: Analyzing Implied Volatility

In this article, we’ll compare implied volatility fr the top oilfield services (or OFS) companies, as rated by Wall Street analysts, for 4Q16.

Is Halliburton’s Indebtedness on the Rise?

In 3Q16, Halliburton’s net-debt-to-adjusted-EBITDA multiple was ~3.8x, or 251% higher than it was a year ago.

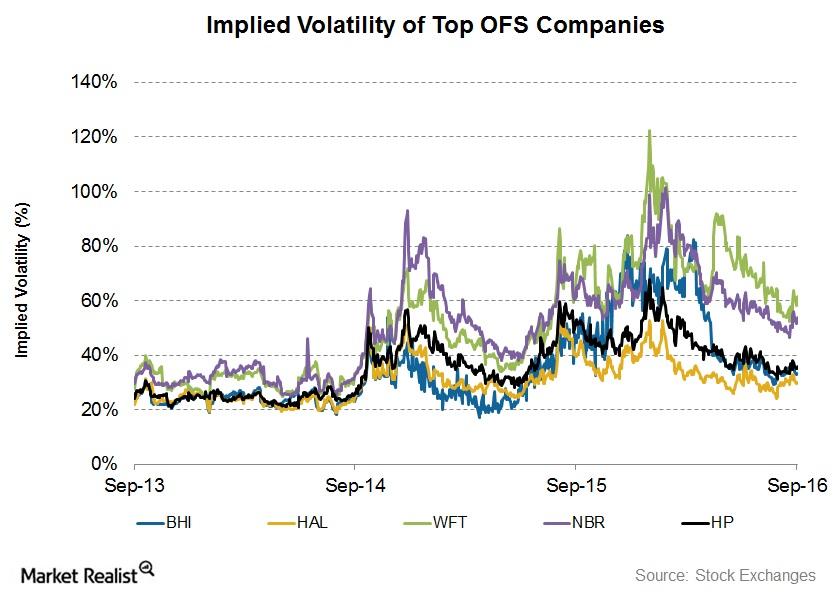

Implied Volatility: Analyzing the Top Oilfield Service Companies

On September 22, Halliburton’s implied volatility was ~28.5%. Since July 20, 2016, its implied volatility rose from ~27% to the current level.

Is It Time for SPN’s Options Traders to Make a Move?

On September 14, 2016, Superior Energy Services (SPN) had an implied volatility of ~51%.

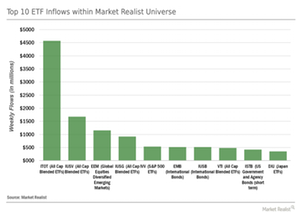

Category Flows: ETF Construction Matters!

The iShares Core S&P Total U.S. Stock Market ETF (ITOT) saw by far the largest inflows within our ETF universe last week.

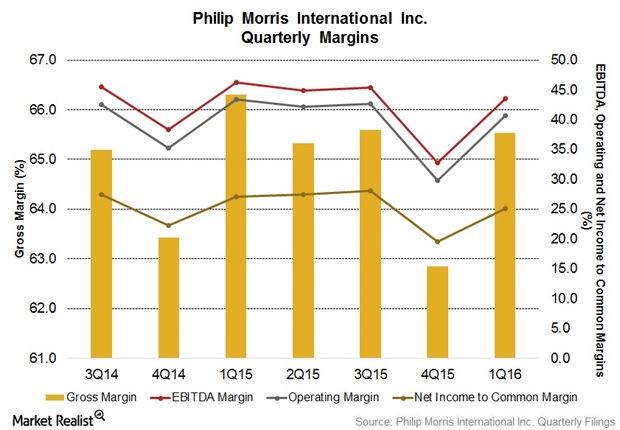

Can ~6% Pricing Variance Help Philip Morris’s Margin Rise in 2Q16?

As a result of decreased operating income, Philip Morris’s (PM) operating margin fell by 2.8% to 41.9% in 1Q16.

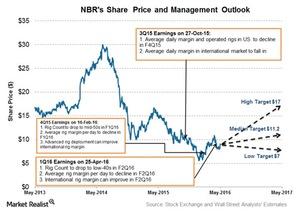

What Are Nabors Industries’ Management Views for 2016?

Nabors Industries’ management expects high performance rigs to perform better when the energy market recovery starts.