Valuation Multiples for Agricultural Chemicals after Brexit

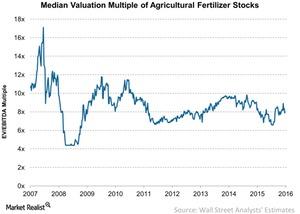

In this part of the series, we’ll look at agricultural fertilizer producers’ valuations from their historical standpoints. Over the long run, valuation multiples impact a company’s share price.

Nov. 20 2020, Updated 1:13 p.m. ET

After Brexit

In this part of the series, we’ll look at agricultural fertilizer producers’ valuations from their historical standpoints. Over the long run, valuation multiples impact a company’s share price. We’ll use an EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple.

Are agricultural companies cheap?

To date, agricultural chemicals companies are trading at a median valuation multiple of 7.8x. That’s below the nine-year average, ever since the previous financial crisis, of 8.6x. The median valuation of these companies reached a low of 6.6x around January 2015 and a high of 8.9x earlier in June 2016.

Where companies are trading

CF Industries (CF), CVR Partners (UAN), and Intrepid Potash (IPI) are trading below the peer median at 6.8x, 6.9x, and 7.2x, respectively. Israel Chemicals (ICL) and Dow Chemicals (DOW) are trading close to the peer median at 7.6x each.

Mosaic (MOS), Agrium (AGU), and PotashCorp (POT) are trading above the peer median at 8x, 9.4x, and 9.9x, respectively. These three companies are among the largest producers of agricultural fertilizers in the market (IYM).

DuPont (DD), Monsanto (MON), and Syngenta (SYT) are also trading far above the peer median at 11x, 11.7x, and 13.5x, respectively.

You can read more about the agricultural fertilizer industry on our Agricultural Fertilizers page.