How Does Seasonality Impact Crude Oil Inventories?

US commercial crude oil inventories fell by around 4.2 MMbbls for the week ending on May 20, 2016—compared to the previous week.

Oct. 8 2020, Updated 1:13 p.m. ET

Crude oil inventories fell last week

US commercial crude oil (USO) (UWTI) (SCO) (UCO) (BNO) inventories fell by around 4.2 MMbbls (million barrels) for the week ending on May 20, 2016—compared to the previous week. The inventories were at 537.1 MMbbls for the week ending May 20, 2016, according to data released by the EIA (U.S. Energy Information Administration) on May 25, 2016. The EIA will release inventory data for the week ending on May 27 on Thursday, June 2.

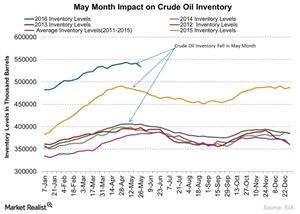

Seasonality and crude oil inventories

In 2012 and 2014, crude oil (UCO) (DBO) (DWTI) inventories fell in May. The five-year average from 2011 to 2015 also indicates that crude oil inventories typically fall in May. This could be attributed to refineries finishing their maintenance activities in April and revving up gasoline production before the US summer driving season starts. So, inventories could fall more in May. The seasonality study also shows that inventory levels could continue decreasing until August. This could mean bullishness in crude oil and oil-related stocks.

This could be important for oil-weighted stocks such as Concho Resources (CXO), Abraxas Petroleum (AXAS), Halcon Resources (HK), Synergy Resources (SYRG), and Kosmos Energy (KOS). Crude oil sentiments also impact ETNs and ETFs such as the United States Brent Oil ETF (BNO), the PowerShares DWA Energy Momentum ETF (PXI), and the ProShares UltraShort Bloomberg Crude Oil (SCO).

In the next part, we’ll analyze the relationship between crude oil and the US Dollar Index.