Country ETFs: Hungry Emerging Market Bulls

Investor appetite for emerging market exposure has been growing steadily, and last week’s fund flows showed that emerging market bulls are still hungry.

Aug. 1 2016, Published 9:18 a.m. ET

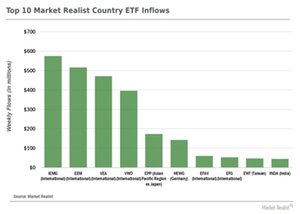

Inflows: emerging markets continue to dominate

Investor appetite for emerging market exposure has been growing steadily, and last week’s fund flows showed that emerging market bulls are still hungry. Within our country ETF universe, the iShares Core MSCI Emerging Markets ETF (IEMG) ranked first in terms of inflows, attracting ~$580 million in capital. Similarly, iShares’ MSCI Emerging Markets ETF (EEM) came in second as investors allocated ~$520 million of cash to the most liquid ETF within our Global Equities Diversified Emerging Markets category.

What’s the story behind the continued inflows into the more volatile emerging market countries?

As we discussed in past series, yield-hungry investors have come to terms with exposure to volatile economies in exchange for higher yield. Last week, we observed a cross-asset dislocation that emphasizes the yield differential argument well. The spread between iShares’ Emerging Markets High Yield Bond ETF (EMHY) and German ten-year bund yields (GDBR10 Index) closed at its widest level in a year on Friday. As EMHY provides exposure to some of the highest-yielding bonds in the emerging market space—including Brazil (EWZ) and Turkey (TUR)—this dislocation illustrates the still-present demand for emerging market debt. Plus, it’s worth noting that both EEM and IEMG have become momentum plays as both ETFs broke out to news highs last week.

Outflows: The bears won’t leave Europe

European-focused country ETFs continued to register large outflows. In fact, four out of the five ETFs with the largest weekly outflows provide exposure to Europe.

The Deutsche X-trackers MSCI EAFE Hedged Equity ETF (DBEF) witnessed the largest outflows of ~$400 million. While the ETF is largely exposed to the United Kingdom and core European countries, note that its biggest geographical exposure is to Japan. As the Bank of Japan disappointed markets last week by announcing lower-than-expected ETF purchases, the magnitude of DBEF’s outflows becomes understandable.

Ongoing worries about Europe’s economic and political future in response to the United Kingdom’s decision to leave the European Union reflected in outflows from the usual suspects. You can see this trend most clearly in WisdomTree’s Europe Hedged Equity Fund (HEDJ) and iShares’ MSCI Eurozone ETF (EZU).