iShares MSCI Turkey

Latest iShares MSCI Turkey News and Updates

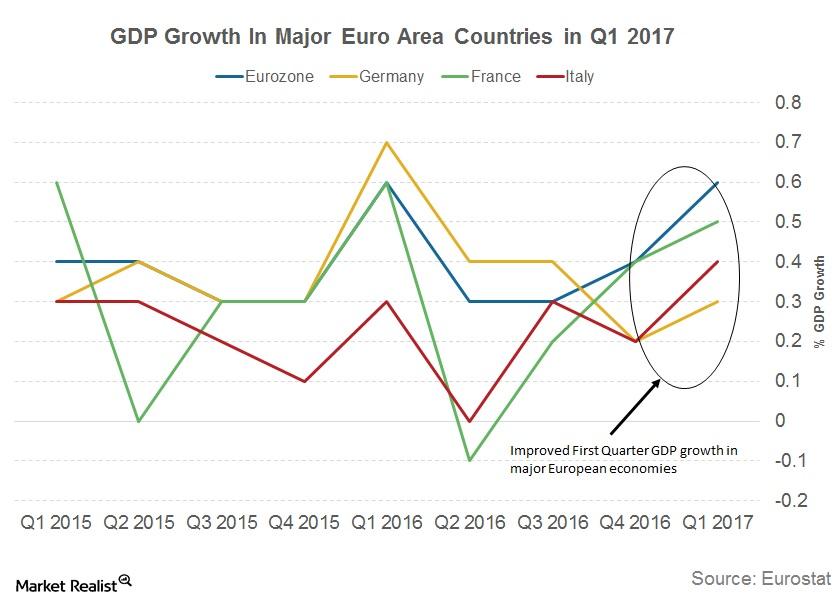

Why the International Monetary Fund Expects Continued Euro Growth

Growth projections for Euro area upgraded The International Monetary Fund (or IMF) has revised its growth projections for France, Germany, Italy, and Spain. Growth projections for Germany (FGM), France (EWQ), and Italy (EWI) were upgraded by 0.2% for 2017, and 0.1% for 2018. Spain (EWP) had a higher upgrade to growth expectations, with a change of […]

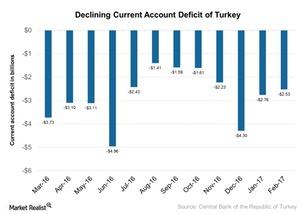

Turkey’s Surging Current Account Deficit and Its Impact in 2017

According to the Turkish government’s latest Medium-Term Economic Plan (or MEP), its forecast for a current account deficit for 2017 is $32 billion, or 4.2% of GDP.

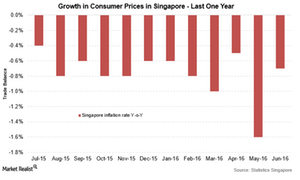

Inflation Levels Fall in Singapore, Malaysian Unemployment Rate Falls

The inflation rate in Singapore fell by 0.7% on an annual basis in June after a 1.6% drop in May and estimated forecasts of a contraction of 1.1%.

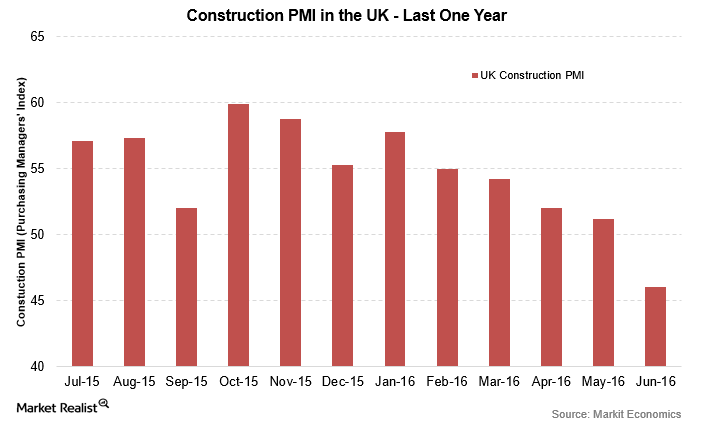

UK Construction PMI Contracts Due to Uncertain Brexit Implications

The United Kingdom’s construction PMI (purchasing managers’ index) came in at 46 for June—compared to 51.2 in the previous month.