How Fertilizer Companies’ Gross Margins Were Pressured in 1Q16

The fertilizer industry moves in cycles and with most companies experiencing a decline in margins, the industry seems to be in the bottom cycle.

June 20 2016, Published 11:59 a.m. ET

Gross margins

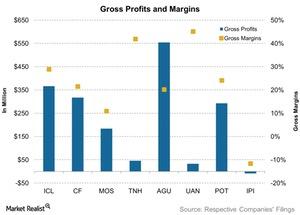

Overall, agricultural fertilizer industry (NANR) saw a margin squeeze during the most recent quarter ended March 2016 while it was not unanticipated. In this part, we will compare agricultural fertilizer producers’ gross margins.

Top performers

Among the above eight companies, CVR Partners (UAN) had the highest gross margin at 45.2% during the quarter. UAN was followed by Terra Nitrogen (TNH), which had a gross margin of 42%. Both companies saw their margins decline YoY (year-over-year) from 46.1% and 48.3%, respectively.

CF Industries (CF), which also produces only nitrogen, saw its margins decline to 22% from 40% YoY as we discussed in the earlier part of this series.

Next was Israel Chemicals, with gross margins at 29%, which declined from 31.8% YoY. PotashCorp (POT) saw its margins decline to 24.2% from 40.1% YoY. However, Agrium’s (AGU) gross margins remained unchanged year-over-year at 20.3% during the quarter.

Bottom performers

Mosaic (MOS) reported gross margins of 11%, which were cut in half compared to 21.4% in 1Q15, while Intrepid Potash (IPI) was the only company to report a deficit in gross margins during the quarter.

Most of the above companies were particularly impacted by declining prices of fertilizers over the quarters while fixed costs are usually high and can impact profitability. This is why Intrepid Potash reported a deficit in gross margin. The fertilizer industry moves in cycles and with most companies experiencing a decline in margins, the industry seems to be in the bottom cycle.

Next, we will discuss EBITDA (earnings before interest, tax, depreciation, and amortization) margins.