Brexit Vote: How Did US Treasury Auctions React?

The US Treasury auctioned 30-year TIPS (VIPSX)(LTPZ) worth $5 billion on June 22.

Nov. 20 2020, Updated 11:29 a.m. ET

30-year TIPS auction

The US Treasury auctioned 30-year TIPS (VIPSX)(LTPZ) worth $5 billion on June 22. Overall demand, measured by the bid-to-cover ratio, surged 27.5% from the previous auction to 2.7x—the highest since the October 2014 auction.

The auction saw solid demand from foreign investors, which are called “indirect bidders,” due to the relative attractiveness of Treasuries. Treasuries pay far higher rates than comparable sovereign debt. As a result, allotment to direct bidders (domestic investors) fell to zero. Even the share of primary dealers, such as JPMorgan Chase (JPM), Credit Suisse (CS), and Morgan Stanley (MS), tanked. Primary dealers are obligated to bid at US Treasury auctions and take up the excess supply.

Seven-year Treasury notes auction

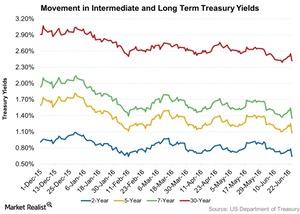

The US Treasury Department holds seven-year Treasury note (or T-note) auctions every month. The auction size was $28 billion, and the auction took place on June 22. Overall demand fell from the previous auction amid worries about the Brexit referendum on June 23.

Meanwhile, direct bids, which include bids from domestic money managers—for example, Invesco (IVZ) and Wells Fargo (WFC)—tanked while indirect bids rose slightly.

ETFs such as the iShares 7-10 Year Treasury Bond Fund (IEF) and the ProShares Ultra 7-10 Year Treasury Fund (UST) provide exposure to seven-year T-notes

Five-year Treasury notes auction

The five-year Treasury notes auction (IEI) was held on June 21, and its size was $34 billion. The bid-to-cover ratio tanked by 12% to 2.3x—the lowest level since July 2009—as investors panicked due to Brexit fears. Meanwhile, direct and indirect bidders showed lower interest in the auction. As a result, fundamental demand fell to its lowest level since April 2015.

Two-year Treasury notes auction

The yield on the two-year Treasury note (SHY) relates to movements in the federal funds rate. So these auctions attract a lot of attention from stock and bond market participants. The auction takes place monthly. Two-year Treasury notes worth $26 billion were auctioned on June 20. Overall demand and fundamental demand fell as the market awaited clues from Yellen’s testimony and Brexit fear took hold.

Two-year floating rate notes auction

$13 billion worth of two-year floating rate notes (or FRNs) was auctioned on June 22. The bid-to-cover ratio was down. Direct bidders didn’t receive any allotment of two-year floating rate notes (or FRNs) while the share of indirect bidders rose.

Funds like the HSBC U.S. Treasury Money Market Fund (HTYXX) and the iShares Floating Rate Bond ETF (FLOT) provide exposure to FRNs.

For more analysis on mutual funds, please visit Market Realist’s Mutual Funds page.