ProShares Ultra 7-10 Year Treasury

Latest ProShares Ultra 7-10 Year Treasury News and Updates

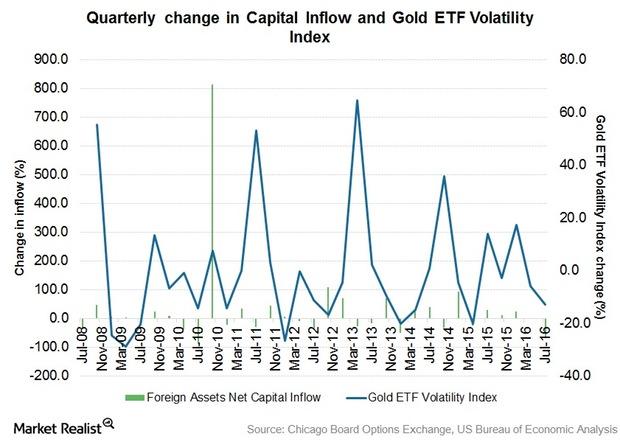

Why Gold ETFs See Robust Net Inflows against Actively Managed Gold Funds

One of the dominant financial trends of the past decade has been a move by investors out of actively managed funds and into passively managed index funds or exchange traded funds (ETFs).Financials Why Treasury auctions impact investors and financial markets

The purpose of Treasury auctions is to obtain financing from markets at the most competitive cost. The yield on these securities is determined through a public auction process. These yields affect the secondary market for U.S. Treasuries. Yields and bond prices move in opposite directions.

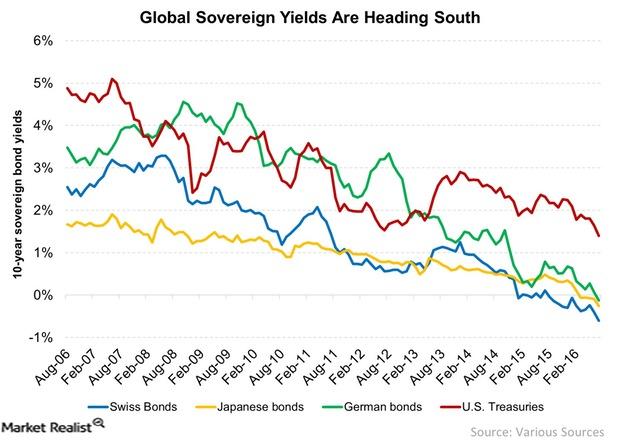

Low Yields: The Reason Lies outside the United States

The reason for low yields lies outside the United States. Global yields have been heading south over the last ten years.