BTC iShares Floating Rate Bond ETF

Latest BTC iShares Floating Rate Bond ETF News and Updates

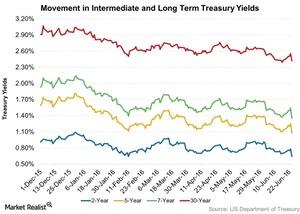

Brexit Vote: How Did US Treasury Auctions React?

The US Treasury auctioned 30-year TIPS (VIPSX)(LTPZ) worth $5 billion on June 22.Financials Why do investors continue to prefer floating-rate notes?

Last week’s Treasury auctions included $13 billion two-year Treasury FRNs auctioned on May 28. The FRNs were indexed to the May 19 13-week Treasury bill auction high rate,.