Invesco Ltd

Latest Invesco Ltd News and Updates

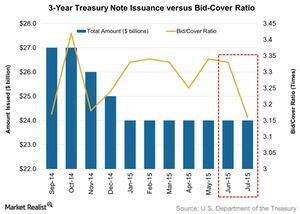

3-Year Treasury Notes’ Overall Demand Fell on July 7

The US Treasury holds monthly auctions of three-year Treasury notes. The latest auction was held on July 7.

Bill Gross: Top Stock Picks with High Dividend Yields

On October 18, CNBC reported Bill Gross top picks. His top stock picks were Annaly Capital (NLY), Invesco (IVZ) and Allergan (AGN).

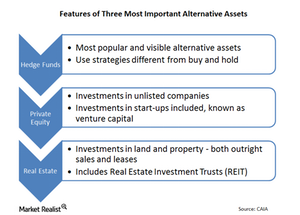

Private equity, hedge funds, and other alternative assets

Private equity is capital invested in companies that aren’t listed on stock exchanges. These alternative assets include venture capital.

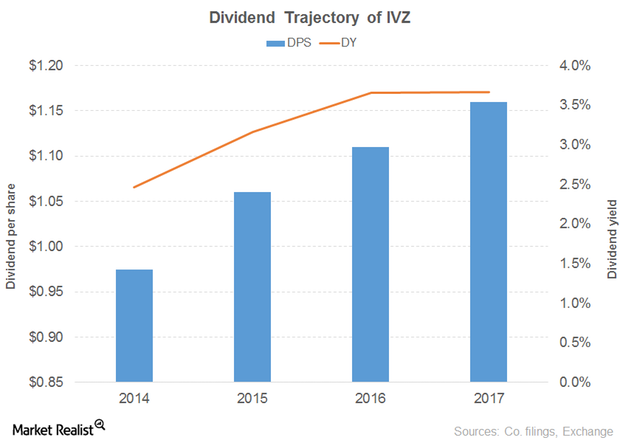

How Invesco’s Dividend Yield Curve Has Evolved

Revenue and earnings Investment management company Invesco (IVZ) saw its revenue fall 8% in 2016, after flat growth in 2015. In 2016, its investment management, service and distribution, and performance fees fell. Its operating expenses fell 3%–5% in 2015 and 2016, and its operating income fell 13% in 2016 after rising 6% in 2015. Meanwhile, its […]

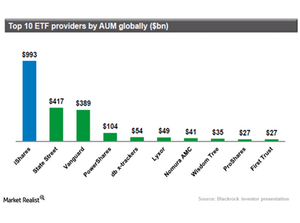

How does BlackRock compare to its peers?

How does BlackRock compare to its peers? BlackRock faces major competition from State Street and Vanguard.