High-Grade Bond Yields Rise on Better Odds of a Rate Hike

Last week, investment-grade bond yields jumped 12 basis points and ended at 3.16%, the highest level since April 5, 2016.

June 8 2016, Updated 1:04 a.m. ET

What are investment-grade bonds?

Investment-grade corporate bonds are debt instruments rated BBB- and above by rating major Standard & Poor’s. Other rating agencies have their own scale of rating a corporate bond as investment-grade. Treasuries are also considered investment-grade.

Mutual funds (MFs) like the PIMCO Total Return Fund Class A (PTTAX) and ETFs such as the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) help you to invest in these instruments. PTTAX invests in investment-grade corporate bonds of companies such as Wells Fargo & Company (WFC), Bank of America (BAC), and UBS Group AG (UBS). LQD invests in high-grade corporate bonds of Credit Suisse AG (CS), Verizon Communications (VZ), Goldman Sachs (GS), Apple (AAPL), and General Electric (GE).

Yield movement

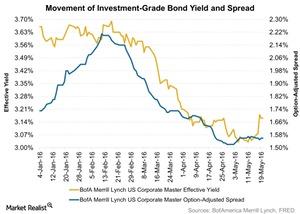

According to the BofA Merrill Lynch US Corporate Master Effective Yield, in January 2016, high-grade bond yields averaged 3.62%. They had risen due to oil price volatility and China’s economic slowdown. In February, yields also averaged 3.62%, but they were mostly down as oil prices stabilized and equity markets rebounded. In March, yields fell sharply after the dovish outlook of the Federal Reserve on the rate hike, and they averaged 3.44%. In April, the downward trend in yields continued due to weak corporate results and a lack of strong guidance by the Federal Reserve on a rate hike. April’s average came in at 3.15%—the lowest level so far in 2016. Meanwhile, yields averaged 3.25% in 2015.

Last week, investment-grade bond yields jumped 12 basis points and ended at 3.16%, the highest level since April 5, 2016, as the FOMC (Federal Open Market Committee) minutes raised the likelihood of a rate hike in the June policy meeting.

Meaning and importance of spreads

The BofA Merrill Lynch Option-Adjusted Spread, or OAS, measures the average difference in yields between investment-grade bonds and Treasuries. Securities selected for calculating this spread are those rated BBB- or higher by Standard & Poor’s.

If spreads are rising or widening, credit conditions can be assumed to be worsening. Spreads also widen when growth is slow and economic conditions are worsening. Conversely, falling or tightening spreads coincide with faster growth and better economic conditions.

How have spreads moved?

In January, February, March, and April 2016, the OAS averaged 1.88%, 2.13%, 1.83%, and 1.62%, respectively. In 2015, spreads had averaged 1.50% in January, 1.43% in February, 1.35% in March, and 1.33% in April.

From January through February 17, spreads rose consistently, which indicated that investors were demanding higher yields because the risk on those bonds had increased. Since then, spreads have seen a continuous decline as the fear of a recession in the US economy has faded and the economy has shown signs of improvement.

Last week, spreads fell 1 basis point and ended at 1.56% on May 20, 2016. Meanwhile, spreads have fallen 17 basis points on a year-to-date basis.

In the next article in this series, we’ll look at the deals and volumes of investment-grade corporate bonds.