Which Upstream Stocks Are More Sensitive to Crude Oil?

In the last three months, Abraxas Petroleum (AXAS) has had the highest positive correlation with WTI crude oil among upstream companies that are part of XOP.

Dec. 4 2020, Updated 10:53 a.m. ET

Upstream stocks have high correlation to crude oil

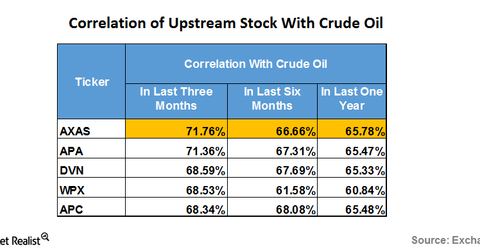

In the last three months, Abraxas Petroleum (AXAS) has had the highest positive correlation with WTI (West Texas Intermediate) crude oil among upstream companies that are part of the SPDR S&P Oil & Gas Exploration & Production ETF (XOP). AXAS had a correlation of about 71.8% with US crude oil (USO) (UWTI) during the same period.

Other upstream stocks that are highly correlated with crude oil

Other upstream stocks such as Apache (APA), Devon Energy (DVN), and WPX Energy (WPX) had correlations of 71.4%, 68.6%, and 68.5% with US (SPY) crude oil in the last three months. The above table shows the correlation of these stocks with WTI crude oil. To find out more about energy ETFs that are correlated to WTI crude oil, read What Are the Key ETFs When Crude Oil Rallies?

Production mix

- AXAS operates with a 65.9% production mix of crude oil.

- APA operates with a 53% production mix of crude oil.

- DVN operates with a 40.4% production mix of crude oil.

- WPX operates with a 21.1% production mix of crude oil.

- APC operates with a 37.9% production mix of crude oil.