Where Does DCP Midstream Stand Compared to Its Peers?

DCP Midstream Partners (DPM) has an enterprise value of $2.7 billion.

Nov. 20 2020, Updated 3:05 p.m. ET

DPM’s enterprise value

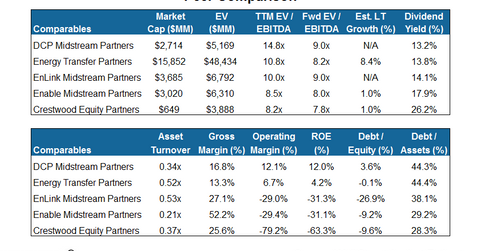

DCP Midstream Partners (DPM) has an enterprise value of $2.7 billion. Energy Transfer Partners (ETP), EnLink Midstream Partners (ENLK), and Enable Midstream Partners (ENBL) have higher enterprise values compared to DPM. The enterprise value (approximately equal to market equity value plus the net debt) is an important metric for the valuation of the entire business. Equity value alone just gives the value to equity holders.

DPM’s forward EV/EBITDA multiple

Of the selected companies, DCP Midstream has the highest consensus forward EV/EBITDA (earnings before interest, taxes, depreciation, and amortization) multiple of 9.0x while Crestwood Equity Partners (CEQP) has the lowest multiple of 7.8x. DPM’s high forward EV/EBITDA most likely reflects a premium for its impressive distribution coverage and strong support from its sponsors, Phillips 66 (PSX) and Spectra Energy (SE).

DPM’s operating margin

DCP Midstream Partners has the highest operating margin of 12.1% among the selected peer group. For 4Q15, DPM’s total operating income was $147 million while operating revenues stood at $1,898 million. DPM forms ~2.8% of the Global X MLP ETF (MLPA).

DPM’s distribution yield

DCP Midstream has the lowest distribution yield among the selected peer group. Low distribution yield indicates less riskiness and low cost of equity capital. Crestwood Equity Partners (CEQP) has the highest distribution yield in the group of 28.3%. CEQP’s high distribution yield can be attributed to its stagnant distribution growth, declining throughput volumes, and high leverage. For an in-depth analysis of CEQP’s recent operating and market performance, read Is Crestwood Equity Partners a Sinking Ship?