Spectra Energy Corp

Latest Spectra Energy Corp News and Updates

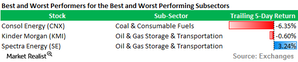

What is XLE? Exploring Midstream Energy Company Exposure

Companies in the midstream sector that are included in the XLE portfolio include Kinder Morgan, Oneok, the Williams Company, and Spectra Energy.

An investor’s guide to Spectra Energy Corp. and its earnings

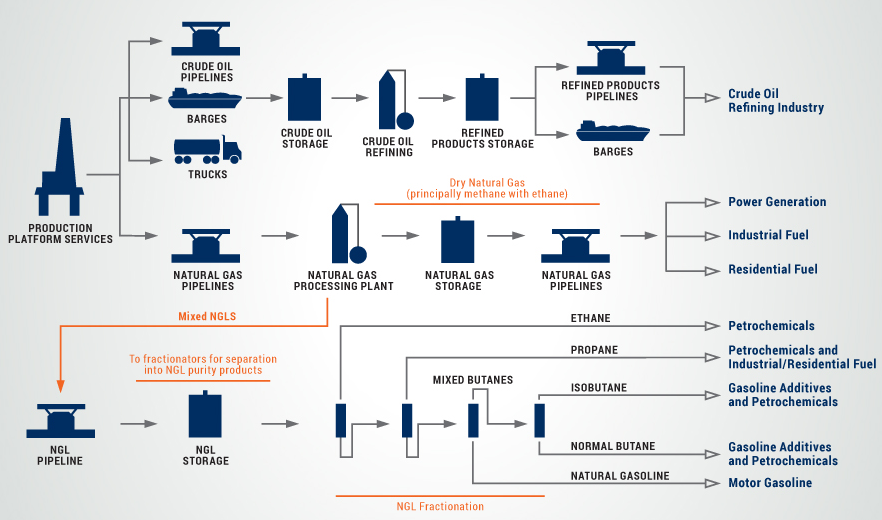

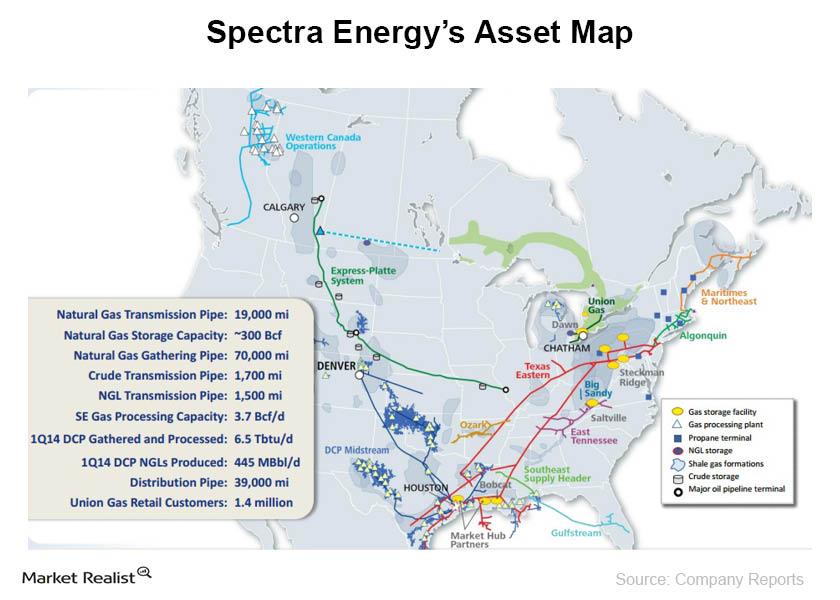

Spectra Energy Corp. (SE), headquartered in Houston, Texas, owns and operates a large and diversified portfolio of natural gas–related assets in North America.

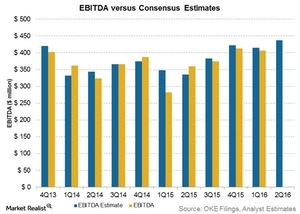

ONEOK Is Expected to Post Higher 2Q16 Earnings

ONEOK (OKE) and ONEOK Partners (OKS) are scheduled to report their 2Q16 results on August 2. Here’s what you need to know.

US Crude Production Dropped in Week Ended July 24, but Why?

According to data from the U.S. Energy Information Administration, US crude production dropped to 9.4 million barrels per day in the week ended July 24.

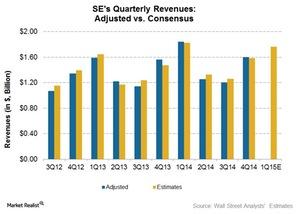

Spectra Energy 4Q14 earnings beat estimates

Spectra Energy 4Q14 adjusted earnings beat estimates by 46%. On average, adjusted EPS has exceeded consensus EPS by ~9% in the past ten quarters.