Business Cycle Perspective: Has the Healthcare Sector Hit Bottom?

This year, the healthcare sector seems to be receding, and the utilities sector seems to be in good gear. This is a sign that the early bear phase is over.

March 31 2016, Published 9:54 a.m. ET

Has the sun set on the healthcare sector?

For those investors who believe that a rising tide lifts all boats, as John F. Kennedy once said, understanding business cycle investing is a must. We’ve covered business cycle investing at length in our series Business Cycle Investing: What Should You Look For?

2014 and 2015 were good years for the healthcare sector. The sector saw some big M&A (merger and acquisition) deals mature, which helped to boost prices. Advances made in biotechnology also boosted the sector’s performance over the period. In fact, biotech has been the best-performing niche by a wide margin over the past four years.

However, these gains are now receding. The year-to-date performances of major stocks and funds tracking the healthcare sector provide evidence of a reversal in the sector’s performance in 2016.

What an M&A spree indicates

One tends to see more M&A either near the top or the bottom of a business cycle. The healthcare sector has witnessed a major M&A spree over the past two years. We’ve seen some really big deals mature in the M&A space.

Healthcare sector: Business cycle perspective

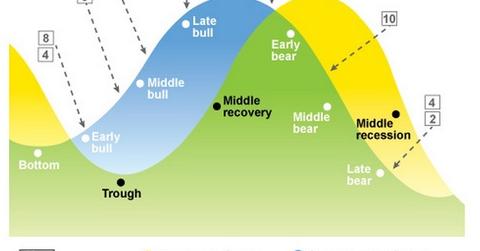

Current growth and stock market (SPY) (IWM) indicators seem to suggest that we’re in the middle of a bear phase. Economic data indicate an economic slowdown: growth is near 2%.

In the year so far, the healthcare sector (XLV) (VHT) (FXH) seems to be receding, while the utilities sector seems to be in good gear. This is a sign that the early bear phase is over, which is when healthcare and consumer non-cyclical perform best, and we’ve entered the middle bear phase, where utilities seem to be driving the markets.

In the economic cycle, we seem to be transitioning from the contraction phase to the trough phase. These facts point to a bottom for the healthcare sector for now.

Let’s take a quick look at some of the major M&A deals and activity that translated to gains for the healthcare sector over 2014–2015.