First Trust Health Care AlphaDEX Fund

Latest First Trust Health Care AlphaDEX Fund News and Updates

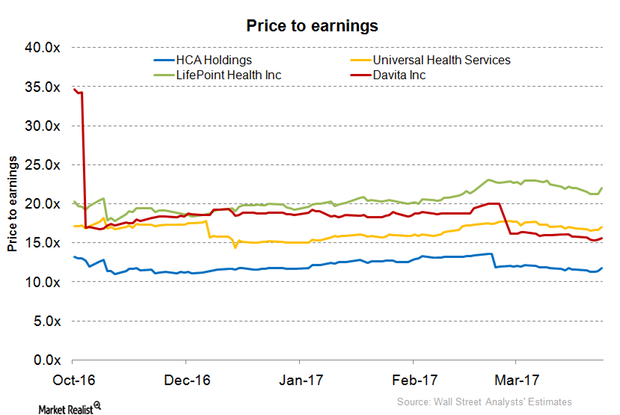

Which Hospital Stocks Are Expected to Benefit Most?

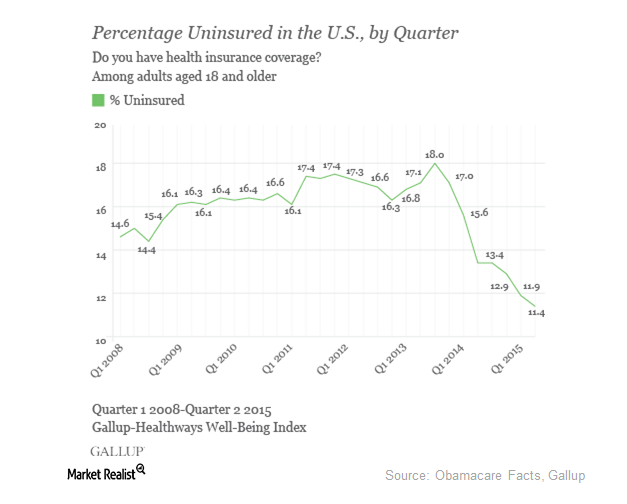

Trumpcare’s failure is considered to be a boon by hospital companies treating a significant portion of Medicaid members.

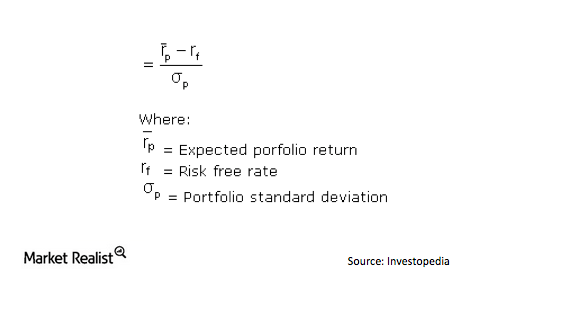

Why you should use the Sharpe ratio when investing in the medical device industry

What is a Sharpe ratio? A Sharpe ratio is a tool that measures the amount of returns for each unit of volatility that’s generated by a portfolio (higher returns and lower volatility equals more returns per unit of volatility). The measurement allows investors to analyze how much return they’re receiving from a portfolio in exchange for […]

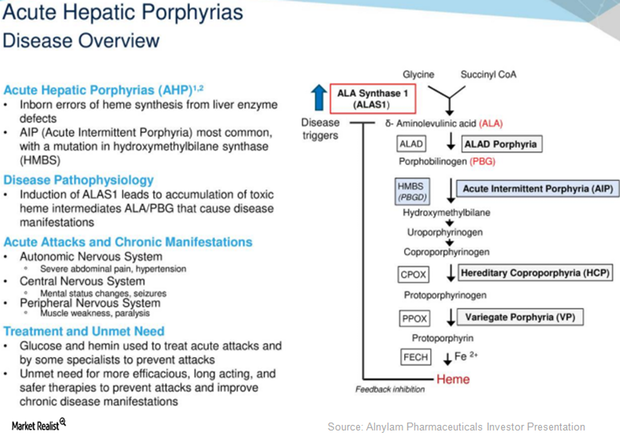

Givosiran May Become Major Growth Driver for Alnylam Pharmaceuticals

On September 7, 2017, Alnylam Pharmaceuticals (ALNY) announced that it had reached an agreement with the US Food and Drug Administration (or FDA) related to the design of the phase three program for investigational RNAi therapeutic Givosiran.

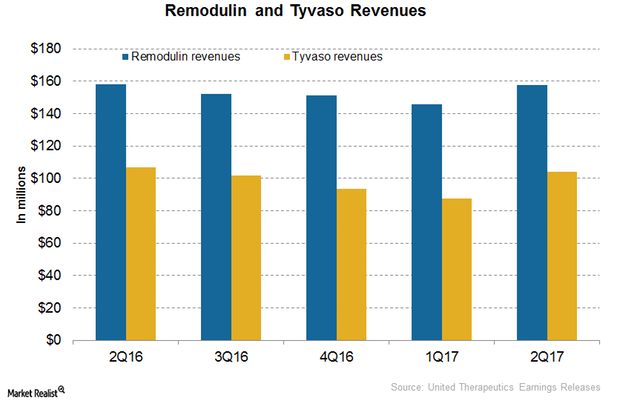

How United Therapeutics’ Remodulin and Tyvaso Are Performing

In 2Q17, United Therapeutics’ (UTHR) Remodulin generated revenues of around $158 million, which reflected ~8% growth on a quarter-over-quarter basis.

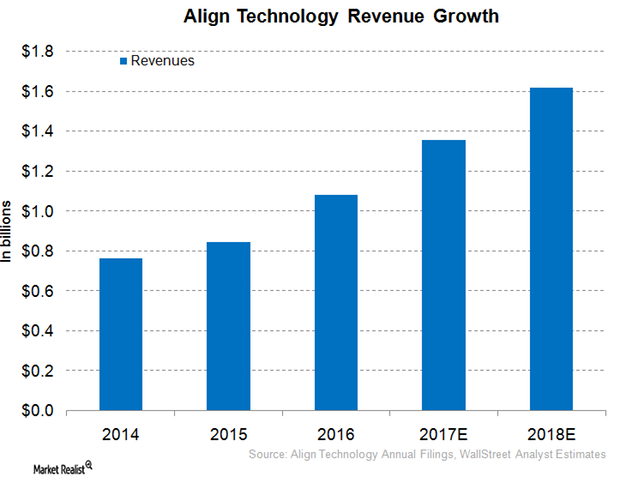

Inside Align Technology’s Robust Revenue Growth Projection for 2017

For fiscal 2017, Align Technology (ALGN) expects its 2017 revenues to grow operationally in the range of 15%–25% YoY.

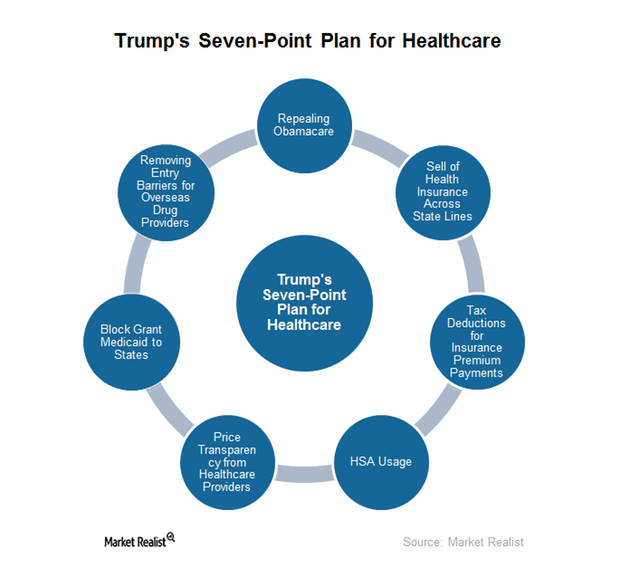

What Is Donald Trump’s Seven-Point Health Plan?

Trump’s healthcare agenda During his campaign, Trump came up with a seven-point plan for the healthcare industry. In this plan, he proposed to repeal the Affordable Care Act. Although a complete repeal doesn’t seem feasible, if applied, it would definitely take a toll on hospitals and insurance companies. In the next article, we’ll discuss the severity of […]

How Could Trump’s Presidency Affect Hospitals and Insurance?

The effects of repealing Obamacare Donald Trump is definitely not in favor of the Affordable Care Act, known as Obamacare. As he wants to repeal the act completely and replace it with another policy, the hospital sector fell on November 9, the day after the election. Trump believes that providing healthcare facilities to illegal immigrants costs […]

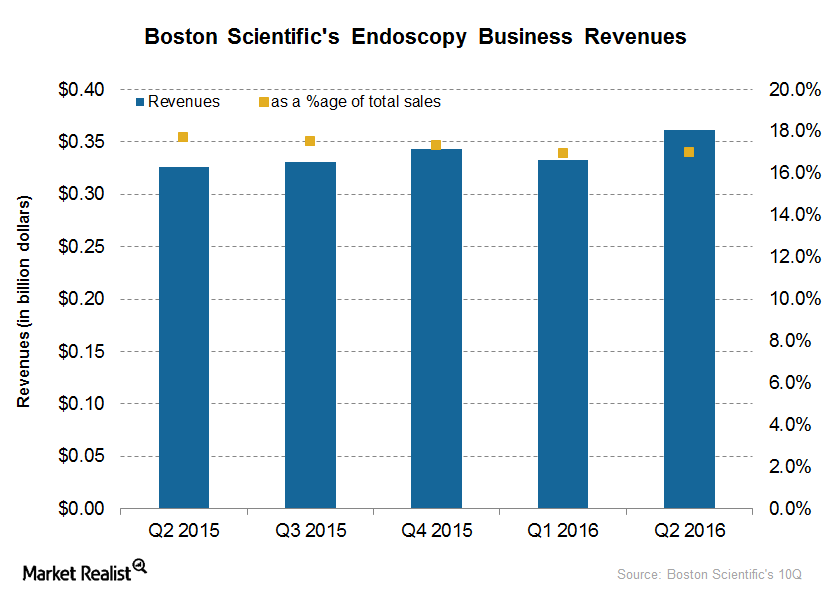

Boston Scientific’s Acquisition of EndoChoice: Must-Know Details

On September 27, 2016, Boston Scientific (BSX) announced the acquisition of EndoChoice Holdings for $210 million.

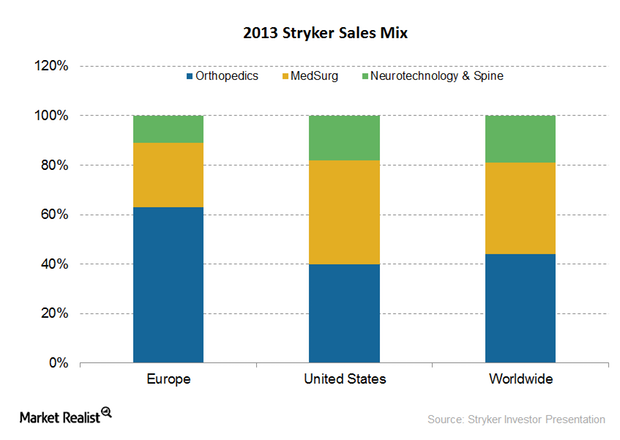

How Stryker Plans to Leverage the Under-Tapped Europe Opportunity

Europe represents a potential growth opportunity for Stryker, as the company currently has a low market share in Europe compared to other developed markets.

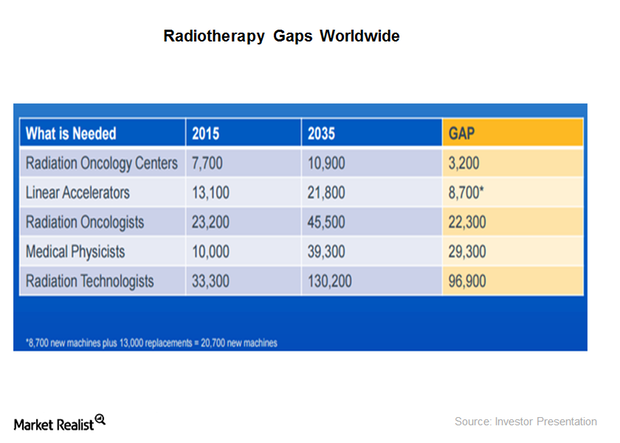

Varian Medical Systems’ Growth Potential in Radiation Oncology

Varian Medical Systems’ next big technology innovation will be high-definition radiotherapy, which is an intelligent treatment delivery system that aims to achieve 100% radiation exposure for the tumor.

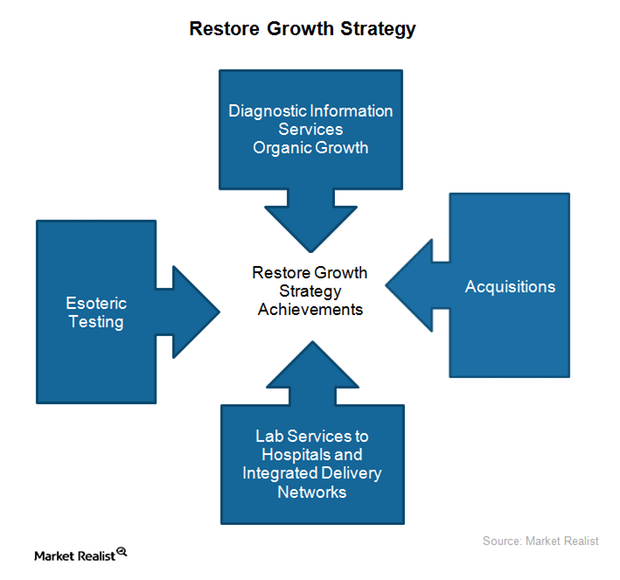

Inside Quest Diagnostics’ Growth Restoration Strategy

Quest Diagnostics has been focusing on developing sales and marketing expertise, increasing esoteric testing, and building relationships with hospitals.

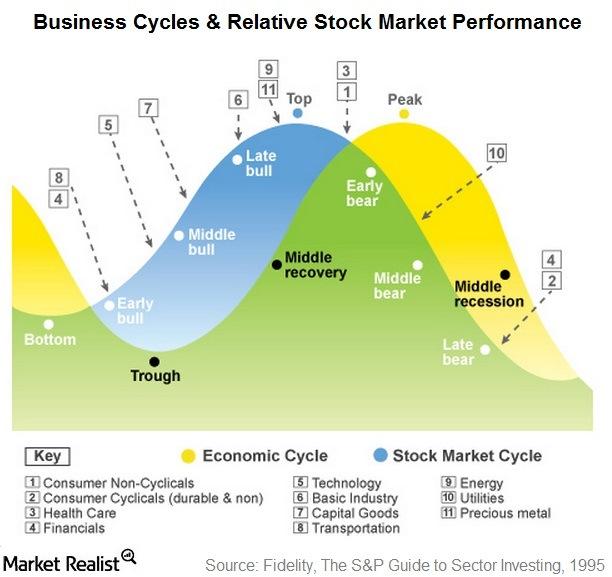

Business Cycle Perspective: Has the Healthcare Sector Hit Bottom?

This year, the healthcare sector seems to be receding, and the utilities sector seems to be in good gear. This is a sign that the early bear phase is over.

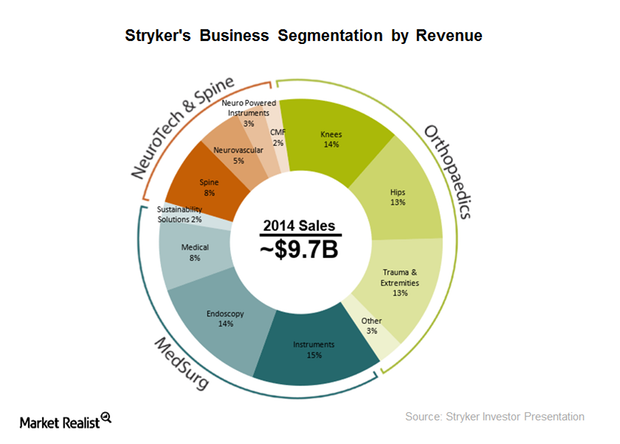

Sizing up Stryker’s Business Model in 2015

Stryker offers a diversified portfolio of more than 60,000 products and services, with a focus on quality outcomes at lower costs through collaborations.

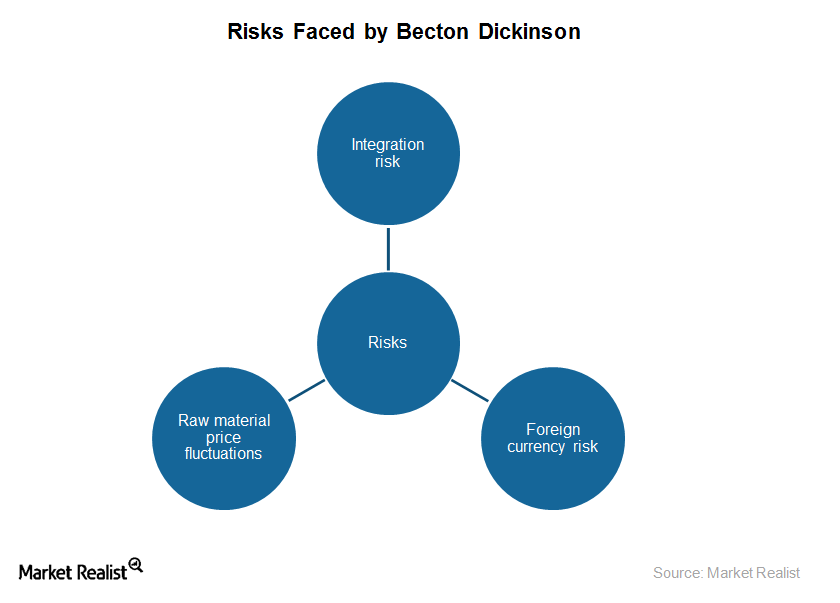

Risks Faced by Becton, Dickinson and Company

As it is susceptible to industry risks, Becton, Dickinson and Company (BDX), or BD, is transforming its business model.

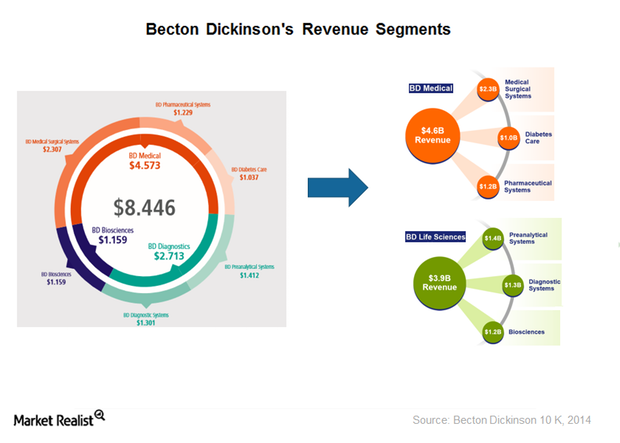

An Overview of Becton, Dickinson and Company’s Business Model

On October 1, 2015, BD underwent organizational restructuring to better align its business model to the strategic vision and goals of the company.

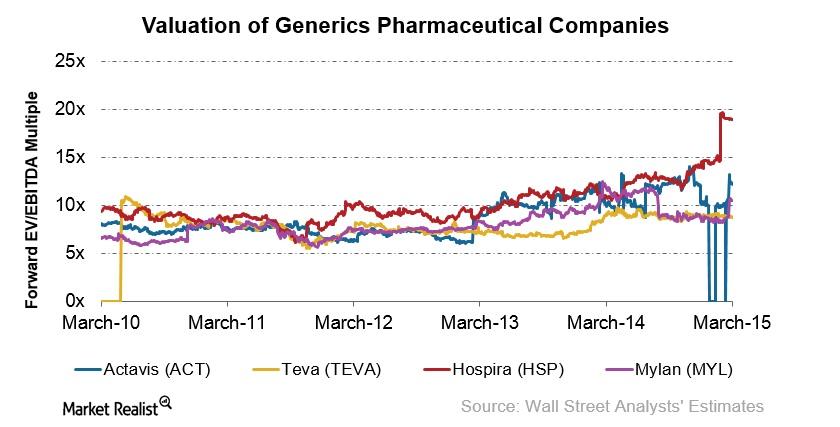

What Drives Generic Pharmaceuticals’ Valuation?

Valuation reflects the market’s perceptions of the industry’s growth prospects. The major value drivers for valuation are ROIC and the growth rate.