How Low Interest Rates Have Hurt Venezuela, Puerto Rico, and Brazil

Low global interest rates have been catastrophic for Brazil. Growth is stagnant while inflation continues to soar.

Nov. 20 2020, Updated 2:47 p.m. ET

Venezuela

Venezuela is on the brink of bankruptcy. Petroleum remains critical to the economy. It accounts for roughly a third of this Latin American (ILF) economy’s GDP (gross domestic product), about half of its government’s revenues, and 80% of its exports. With the oil price slide, this economy is sure in need of intensive care. According to Bill Gross, the “current oil prices are (in significant part) a function of low interest rate central bank policies over the past seven years.”

The economy’s balance of trade plummeted to -$782 million by the third quarter of 2015 as against $6,811 million in 3Q14. Growth contracted by 5% in 2015 and the country’s revenues fell by 70% due to the oil price slump.

Puerto Rico

Overspending by the government has led this American territory into a situation of default. The ultra-low interest rate regime in most of the world has further added to the economy’s woes. Puerto Rico hasn’t been able to earn adequate investment returns to fill in for the overpromised retirement benefits prevalent in the economy.

For an economy with a double-digit unemployment rate of 12.2%, massive fiscal debt, low per capita income, and a high cost of living, the worldwide low interest rate regime adds insult to injury to the economy’s distressed situation. Read, How did Puerto Rico become the fiscal wreck it is today? for more perspective.

Brazil

Low global interest rates have been catastrophic for Brazil. The economy was declining on account of the Petrobras (PBR) scandal involving Dilma Rousseff’s government and on account of stagflation. Growth is stagnant while inflation continues to soar. The economy is characterized by low growth, high unemployment levels, and a rising inflation rate. The commodity price slump only catalyzed the doom. Commodity producers such as Vale (VALE), Gerdau (GGB), and Companhia Siderúrgica Nacional (SID) have been hurt badly.

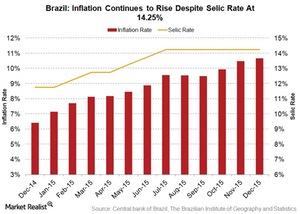

Brazil (EWZ) is in recession, which means it has been recording negative growth rates for the last six quarters. Inflation in the economy continues to soar, and is at 10.7% despite the central bank’s several attempts at interest rate hikes. As a consequence, the Selic rate now stands at 14.3%.

“No country over time can issue debt at 6-7% real interest rates with negative growth,” said Bill Gross. Brazil’s ten-year junk-rated sovereigns currently yield 16.6%, and inflation stands at 10.7%. Gross also noted that the government in Brazil has been issuing and rolling over more than $100 billion in currency swaps instead of drawing from their dollar reserves. While the government intends to deceive the world by showing $300 billion in reserves that apparently back the economy’s credit, little have they realized that this exercise is costing them 2% of GDP annually. Their fiscal deficit now stands at 9% of GDP.