Companhia Siderurgica Nacional

Latest Companhia Siderurgica Nacional News and Updates

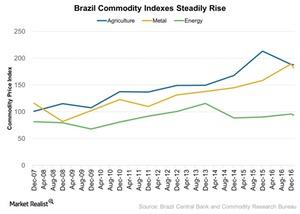

Will Rising Commodity Prices Help Brazil Recover?

Brazil (EWZ) is expected to see a reversal of the downward trend in its economic growth in 2017, mostly with the help of rising commodity prices and improvements in exports.

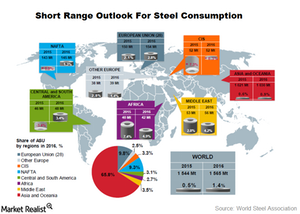

Global Steel Consumption Is Expected to Grow 0.5% in 2015

The WSA expects global steel consumption to grow by 0.5% in 2015 on a YoY basis. This was highlighted in the short range outlook released on April 20.