Gerdau SA

Latest Gerdau SA News and Updates

Are Commodities a Boon or a Bane for Brazil?

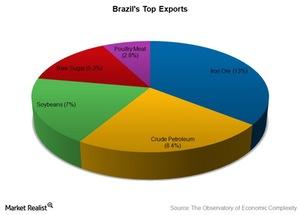

Brazil (EWZ) is rich in commodities. It’s among the top producers and exporters of iron ore, crude petroleum, soybeans, sugar, and meat.

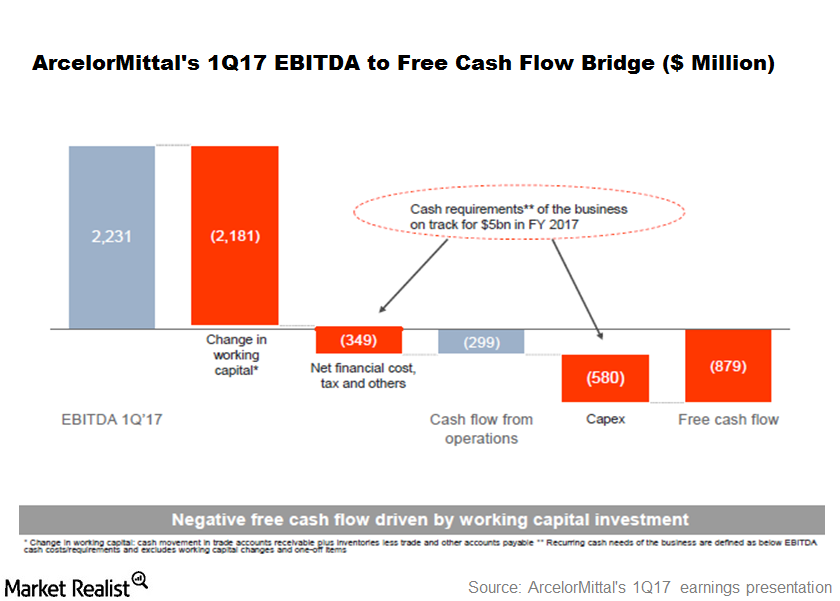

Why Investors Shouldn’t Fret over MT’s Negative Free Cash Flow

In this article, we’ll look at ArcelorMittal’s 1Q17 cash flow and leverage positions. As of the end of 1Q17, ArcelorMittal had net debt of $12.1 billion.

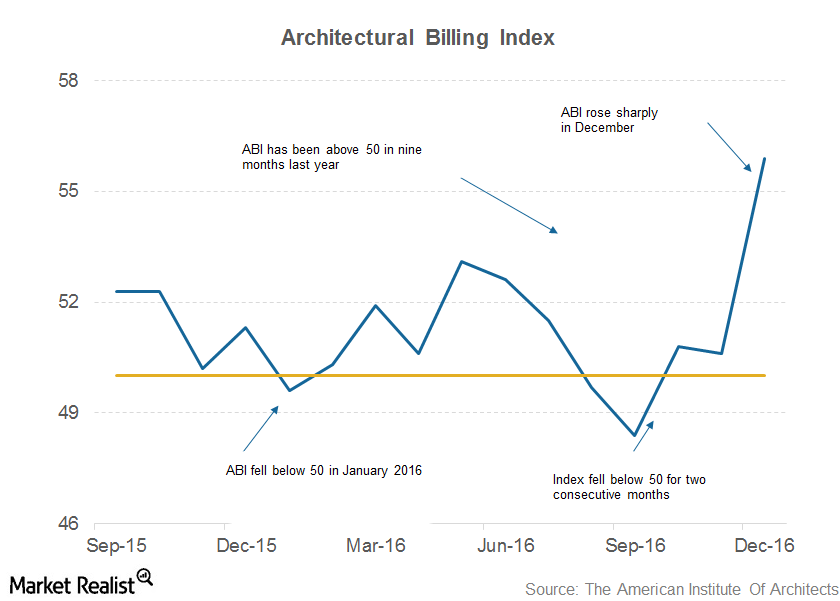

US Steel Demand: The Latest Indicators

Steel demand is a key driver of steel companies’ performances, and the construction sector accounts for almost 40% of US steel demand.

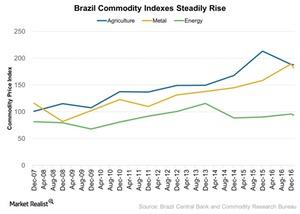

Will Rising Commodity Prices Help Brazil Recover?

Brazil (EWZ) is expected to see a reversal of the downward trend in its economic growth in 2017, mostly with the help of rising commodity prices and improvements in exports.