The Wasatch Emerging India Fund Portfolio Composition

As of December 2015, the Wasatch Emerging India Fund has ~$69.2 million in assets under management. As of September 30, 2015, the fund had 76 holdings in its portfolio.

Jan. 16 2016, Published 12:54 a.m. ET

The Wasatch Emerging India Fund

The Wasatch Emerging India Fund (WAINX) invests primarily in small-cap and mid-cap Indian companies. The fund invests with the aim of long-term capital appreciation of the portfolio.

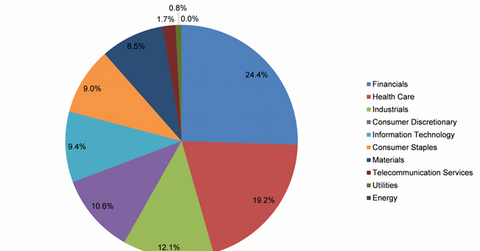

As of December 2015, the Wasatch Emerging India Fund has ~$69.2 million in assets under management. As of September 30, 2015, the fund had 76 holdings in its portfolio. The following chart shows the sector-wise composition of the portfolio.

Holdings

The top ten holdings form about 29% of the portfolio. As compared to the Matthews India Fund (MINDX) and the ALPS Kotak India Growth Fund (INDAX), the concentration in the top ten holdings is much lower in WAINX. The top ten holdings of WAINX include stocks such as Glenmark Pharmaceuticals, Cognizant Technology Solutions – Class A, HCL Technologies, and MakeMyTrip (MMYT).

Dr. Reddy’s Laboratories (RDY) is a key competitor of Glenmark Pharmaceuticals. Infosys (INFY) is a key competitor of Cognizant Technology Solutions and HCL Technologies. Axis Bank is also one of the top ten holdings of the fund. HDFC Bank (HDB) and ICICI Bank (IBN) are key competitors of Axis Bank.

WAINX is a relatively new fund as compared to the Matthews India Fund (MINDX) and the ALPS Kotak India Growth Fund (INDAX). WAINX was launched on April 26, 2011.

The chart above shows the portfolio composition of the fund in comparison to the portfolio composition of the benchmark. The MSCI India IMI is the benchmark index.

The fund’s sectoral holding has some notable differences compared to that of the benchmark. While the fund’s highest exposure is to financials, the benchmark’s highest exposure is to information technology. Plus, 19.4% of MSCI India IMI is invested in information technology, and just 9.4% of the fund’s portfolio is allocated to the sector. As of September 30, 2015, the fund had no exposure to the energy sector.

In the next article, we will look at the performance of WAINX.