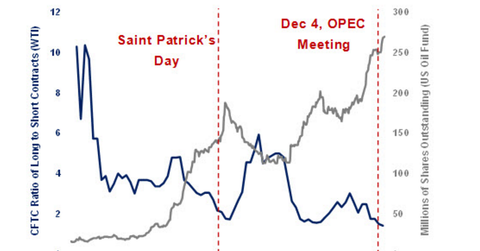

Long Positions Fall in the CFTC’s Commitment of Traders Report

The CFTC’s COT report states that hedge funds reduced their long positions for the week ending January 12, 2016. The net long positions fell by 20,673 contracts to 163,504 contracts during the week.

Nov. 20 2020, Updated 2:49 p.m. ET

The CFTC’s Commitment of Traders report

The CFTC (U.S. Commodity Futures Trading Commission) published its weekly COT (Commitment of Traders) report on January 15, 2016. The CFTC classifies traders as commercial and noncommercial. The noncommercial traders include hedge funds and speculators. The commercial traders are the oil producers. They use the futures and options markets for hedging activity.

Commercial and noncommercial traders’ positions

The CFTC’s COT report states that hedge funds reduced their long positions for the week ending January 12, 2016. Hedge funds reduced their bullish positions for the second consecutive week. The net long positions fell by 20,673 contracts to 163,504 contracts for the week ending January 12. The long positions are at their lowest level in the last five years. Meanwhile, commercial traders continued to increase their bearish positions for the same period. Noncommercial traders reduced their bearish positions to 178,240 contracts from 188,565 contracts for the week ending January 12, 2016

However, the net bearish positions rose by 15% for the week ending January 12, as compared with the previous week. This is the highest number of short positions in the last ten years. Smart money traders, or hedge funds, suggest that Iran’s oil flooding the market (which we’ll cover in the next part of this series) will continue to put pressure on crude oil prices. However, China’s oil demand could support oil prices.

The open interest came in at 1,756,232 contracts for the week ending January 12. Open interest rose for the fourth consecutive week. Short sellers will continue to kill the crude oil market as pessimism is ruling the market. Bullish traders are sidelined due to negative fundamentals all over the place in the oil market.

The high total cost of producing crude oil affects US upstream players like Whiting Petroleum (WLL), Hess (HES), Energy XXI (EXXI), Halcón Resources (HK), and Goodrich Petroleum (GDP) and will continue to put pressure on their sustainability.

ETFs like the United States Oil Fund (USO), the iShares U.S. Oil Equipment & Services ETF (IEZ), the ProShares UltraShort Bloomberg Crude Oil ETF (SCO), the Vanguard Energy ETF (VDE), and the First Trust Energy AlphaDEX Fund (FXN) are also influenced by the volatility in the oil market.

Read the next part of this series for the latest update on Iran’s crude oil production.