Energy XXI Ltd

Latest Energy XXI Ltd News and Updates

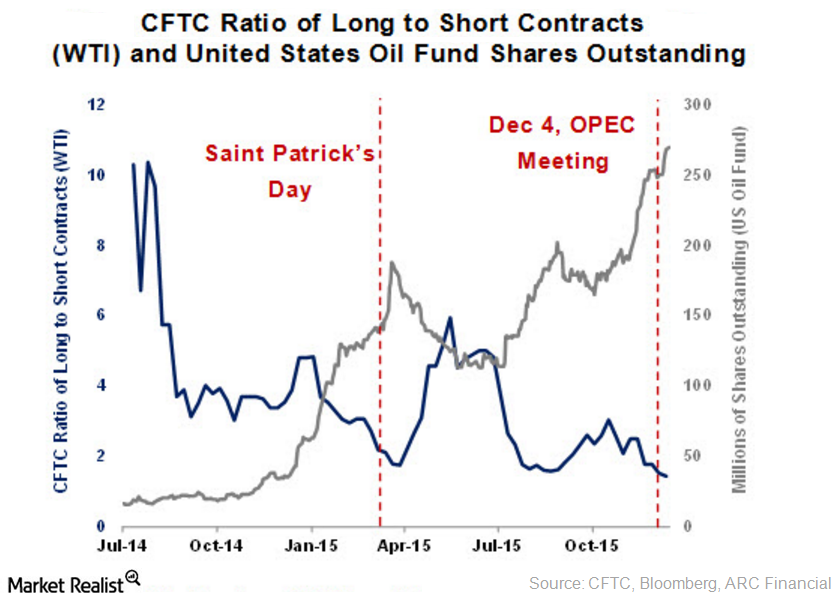

Long Positions Fall in the CFTC’s Commitment of Traders Report

The CFTC’s COT report states that hedge funds reduced their long positions for the week ending January 12, 2016. The net long positions fell by 20,673 contracts to 163,504 contracts during the week.

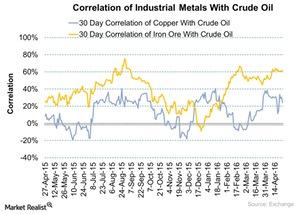

Analyzing the Correlation of Crude Oil and Industrial Metals

In the past year, US crude oil was more correlated with iron ore than copper. In August 2015, the correlation between crude oil and iron ore touched 75.5%.

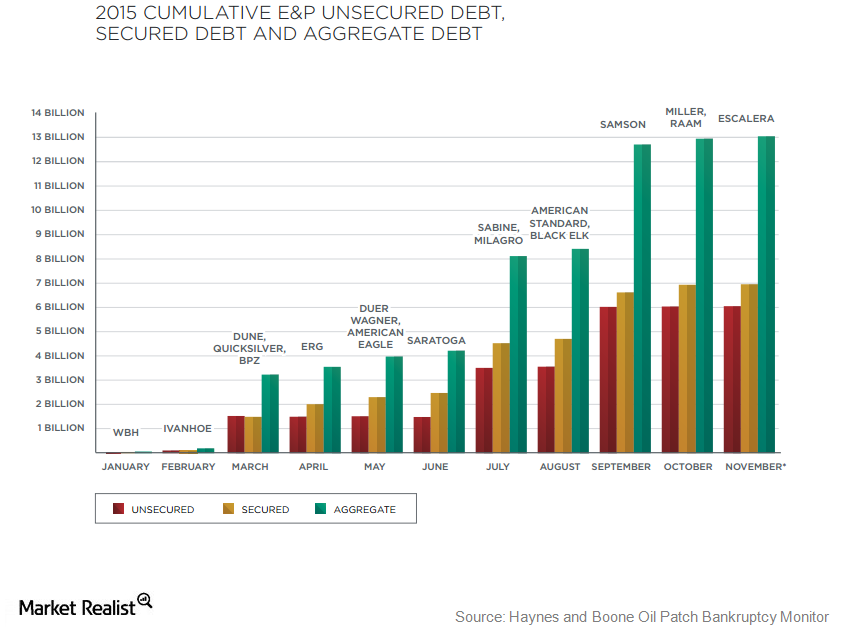

US Oil and Gas Companies’ Debt Exceeds $200 Billion

US oil and gas exploration and production companies are under severe pressure.

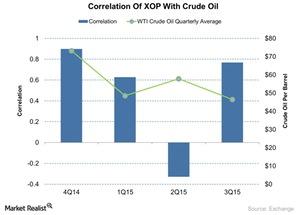

An Analysis of the Correlation between XOP and Crude Oil

Here we’ll present the results of a quarterly correlation analysis between crude oil and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).