Gasoline and Distillate Inventories Overshadow Crude Oil Market

The EIA (U.S. Energy Information Administration) reported that the US gasoline inventory rose by 8.4 MMbbls to 240.4 MMbbls for the week ending January 8, 2016.

Jan. 14 2016, Published 8:06 a.m. ET

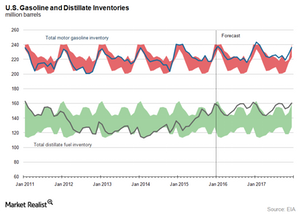

EIA’s gasoline and distillate inventories

The EIA (U.S. Energy Information Administration) reported that the US gasoline inventory rose by 8.4 MMbbls to 240.4 MMbbls for the week ending January 8, 2016. This rise was less than the rise of 10.6 MMbbls during the week ending January 1, 2016. Similarly, the US distillate inventory rose by 6.1 MMbbls to 165.6 MMbbls for the week ending January 8, 2016.

EIA’s gasoline and distillate inventories by region

The EIA added that of the five major US storage hubs, the Gulf Coast, the Midwest, and the East Coast recorded the highest gasoline inventories for the week ending January 8, 2016. To learn more about the US storage hubs, read the previous part of this series. Gasoline inventories in these regions came in at 82.6 MMbbls, 57.6 MMbbls, and 62.9 MMbbls, respectively.

Similarly, distillate inventories were highest in the Gulf Coast, the Midwest, and the East Coast regions. The US distillate inventories were 48.1 MMbbls, 33.3 MMbbls, and 64.9 MMbbls, respectively, in these three regions.

EIA’s gasoline and distillate inventory estimates and impact

Reuters’ surveys estimated that the US gasoline inventory would rise by 2.7 MMbbls and the US distillate inventory would rise by 2 MMbbls for the week ending January 8, 2016. The greater-than-expected rise in refined products inventories weighed on crude oil prices. Lower crude oil prices benefit US refiners like Phillips 66 (PSX), Western Refining (WNR), Alon USA Partners (ALDW), and Northern Tier Energy (NTI). On the other hand, higher refined products inventories put pressure on refiners. The refined products inventories rose due to the fall in retail demand this winter season. Read about refinery demand in the fifth part of this series.

The fall in retail and refinery demand also affects crude oil prices and oil producers like Chevron (CVX), Whiting Petroleum (WLL), and Continental Resources (CLR). ETFs like the ProShares UltraShort Bloomberg Crude Oil ETF (SCO), the Vanguard Energy ETF (VDE), and the First Trust Energy AlphaDEX Fund (FXN) are also affected by the ups and down in the oil market.

Read why US crude oil production is crucial for the global crude oil market in the next part of this series.