Alon USA Partners LP

Latest Alon USA Partners LP News and Updates

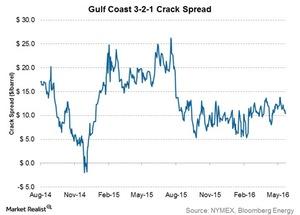

How a Fall in Crack Spreads Is Hurting Refining MLPs

The Gulf Coast 3-2-1 crack spread was $10.4 per barrel on June 16, 2016.

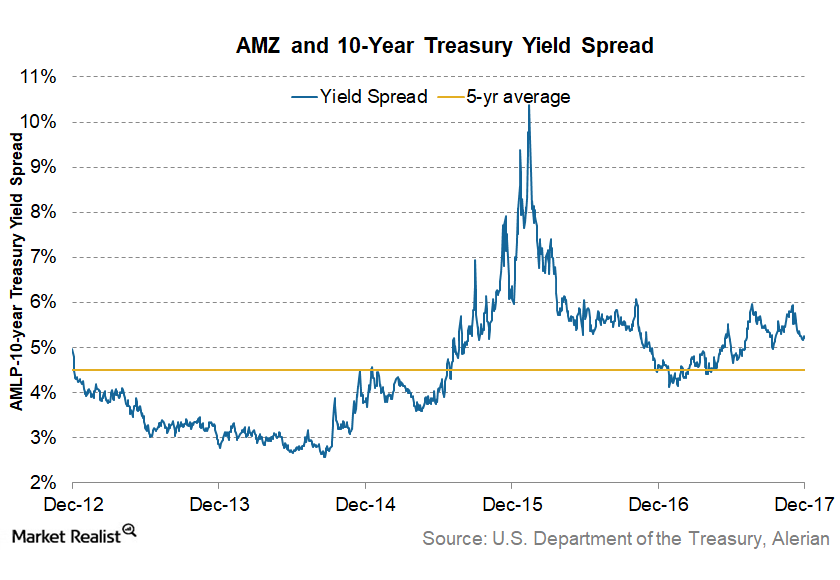

How Do These MLPs Look in 2018?

MLPs had a strong start to the new year. The Alerian MLP Index rose 5% in the first week of 2018.

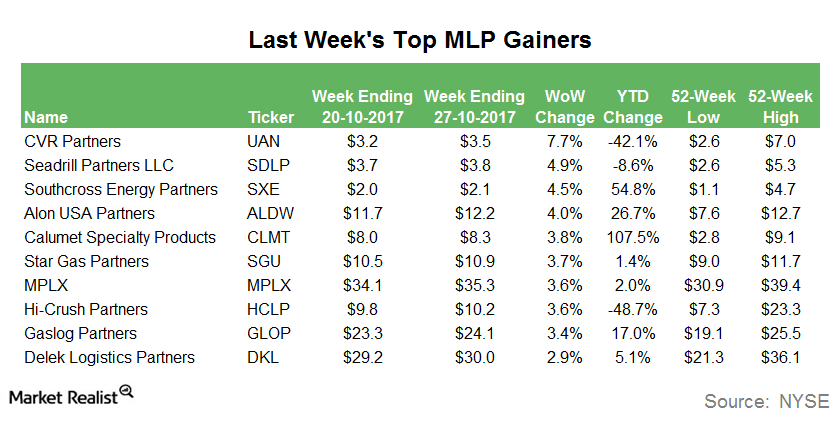

Last Week’s Top MLP Gainers

CVR Partners (UAN), the MLP mainly involved in the production of nitrogen fertilizers, was the top MLP gainer last week. CVR Partners rose 7.7%.

These Energy Stocks Rose the Most Last Week

Oil field services stock CARBO Ceramics (CRR) was the biggest gainer among the energy sector stocks last week.

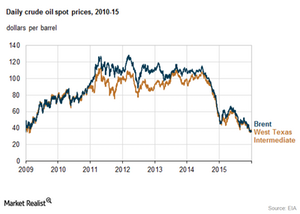

WTI and Brent Crude Oil Prices in 2015, Lowest since 2009

US benchmark WTI crude oil prices averaged at $49 per barrel in 2015. WTI and Brent crude oil prices closed below $40 per barrel in 2015.

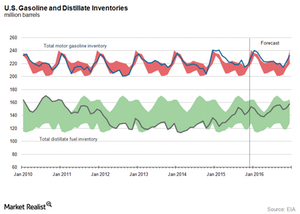

Will the Gasoline and Distillate Inventory Pressure Crude Oil Prices?

The API (American Petroleum Institute) published its weekly crude oil, gasoline, and distillate inventory report on January 12, 2016.