Could US Gasoline Demand Fall in the Coming Months?

The EIA estimates that US gasoline demand will fall 275.0 Mbpd (thousand barrels per day) to 9.5 MMbpd (million barrels per day) August 4–11, 2017.

Aug. 24 2017, Updated 6:51 a.m. ET

US gasoline demand

The EIA (U.S. Energy Information Administration) estimates that US gasoline demand will fall 275.0 Mbpd (thousand barrels per day) to 9.5 MMbpd (million barrels per day) August 4–11, 2017.

Gasoline demand fell 2.8% week-over-week and 240.0 Mbpd, or 2.5%, year-over-year. Gasoline demand fell for the second consecutive week.

Lower gasoline demand could have a negative impact on gasoline (UGA) and crude oil (XLE) (XOP) prices. Lower crude oil (UWT) (DWT) prices have a negative impact on oil producers. The top energy companies’ returns as of August 22, 2017, sorted by the largest volume (or shares traded), are as follows:

US gasoline demand’s peaks and lows

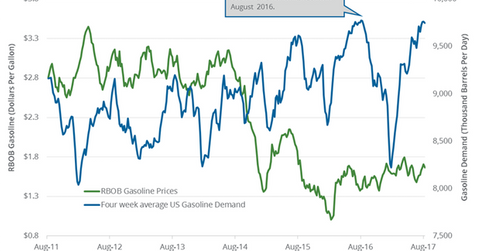

US gasoline demand was at 8.0 MMbpd in January 2017. It was the lowest level since February 2014. On the other hand, US gasoline demand hit 9.8 MMbpd in July 2017, the highest level ever. Demand rose due to record driving in the summer season.

US gasoline consumption estimates

The EIA estimates that US gasoline consumption will average 9.3 MMbpd in 2017 and 9.4 MMbpd in 2018. US gasoline consumption could hit a record in 2018. Consumption averaged 9.3 MMbpd in 2016, a record high.

Impact

US gasoline demand may fall after the summer. However, US gasoline demand is expected to rise over the long term. Record gasoline demand would benefit gasoline (UGA) prices. Higher gasoline prices would drive crude oil (SCO) (BNO) (DBO) prices higher.

In the next part, we’ll look at India’s crude oil production and demand.