How Top Crude Oil Consumers Influence the Crude Oil Market

The US and China are the top oil consuming countries in the world. The demand from the US is expected to be robust in 2016.

Dec. 28 2015, Published 2:29 p.m. ET

Crude oil consumers

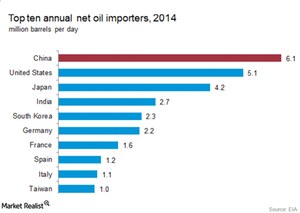

The US and China are the top oil consuming countries in the world. The demand from the US is expected to be robust in 2016. However, China imported 6.7 MMbpd (million barrels per day) of crude oil in November 2015 compared to November 2014. The slowing Chinese economy due to weak industrial output and weak domestic demand could affect oil demand in 2016. Lower demand would negatively affect oil prices and companies like PetroChina Company (PTR) and Petrobras (PBR).

Demand from Japan, India, and South Korea

The slowing Japanese economy also affects the demand for crude oil. Japan is among the largest crude oil importers. South Korea’s imports have also fallen lately. However, India’s gasoline and oil imports peaked to their largest in the last five months in October 2015. The improving gasoline demand benefits oil refiners like Phillips 66 Company (PSX), Tesoro (TSO), and Valero Energy (VLO). Improving oil demand benefits oil producers like Royal Dutch Shell (RDS.A), Eni (ENI), and BP (BP).

The demand from the Eurozone is also expected to be low due to economic recovery in the Eurozone. A mild winter in 2015 also curbed the heating demand and led to falling winter demand for crude oil and its refined products.

ETFs such as the First Trust Energy AlphaDEX ETF (FXN), the United States Oil ETF (USO), and the iShares US Oil Equipment & Services ETF (IEZ) are also affected by the roller coaster ride in the oil and gas market.

In the next part of this series, we’ll discuss whether crude oil will remain at its current level or not.